Free 40X Oregon Form

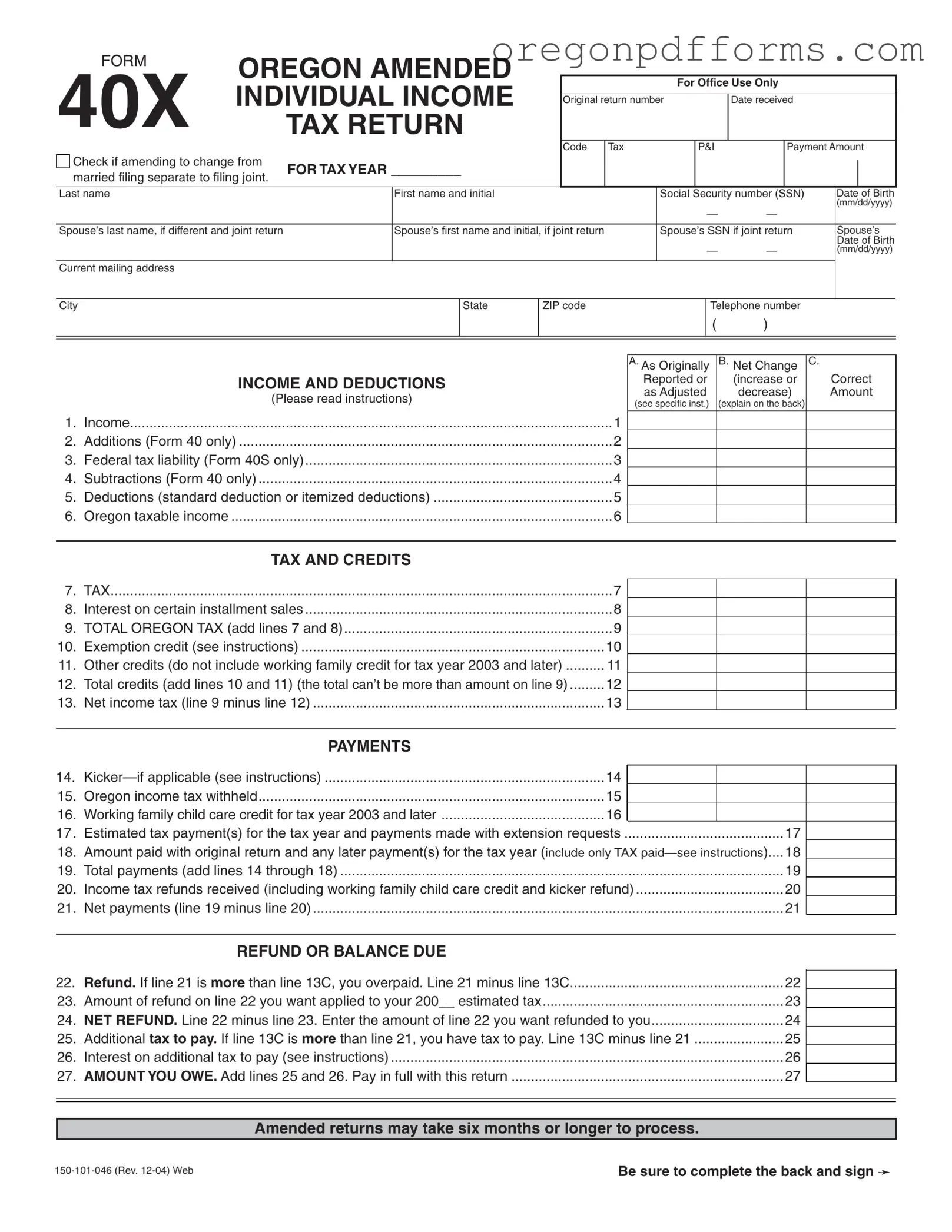

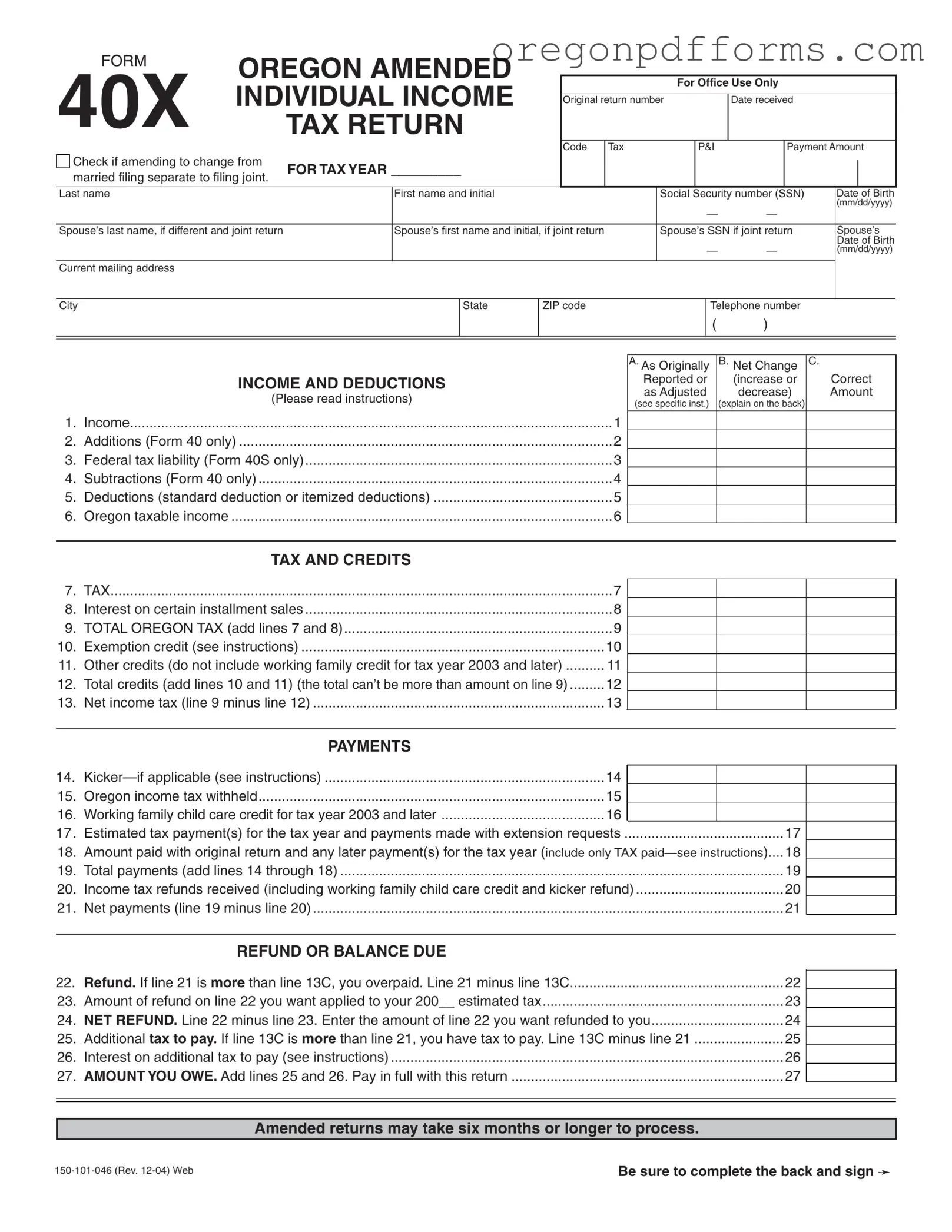

The 40X Oregon form is an amended individual income tax return used by residents of Oregon to correct or update their previously filed tax returns. This form allows taxpayers to change their filing status, report additional income, or make adjustments to deductions and credits. Proper completion of the 40X form is essential for ensuring accurate tax reporting and compliance with state tax regulations.

Open My 40X Oregon

Free 40X Oregon Form

Open My 40X Oregon

Open My 40X Oregon

or

Get PDF

A few steps left to finish this form

Complete 40X Oregon online with easy edits and saving.