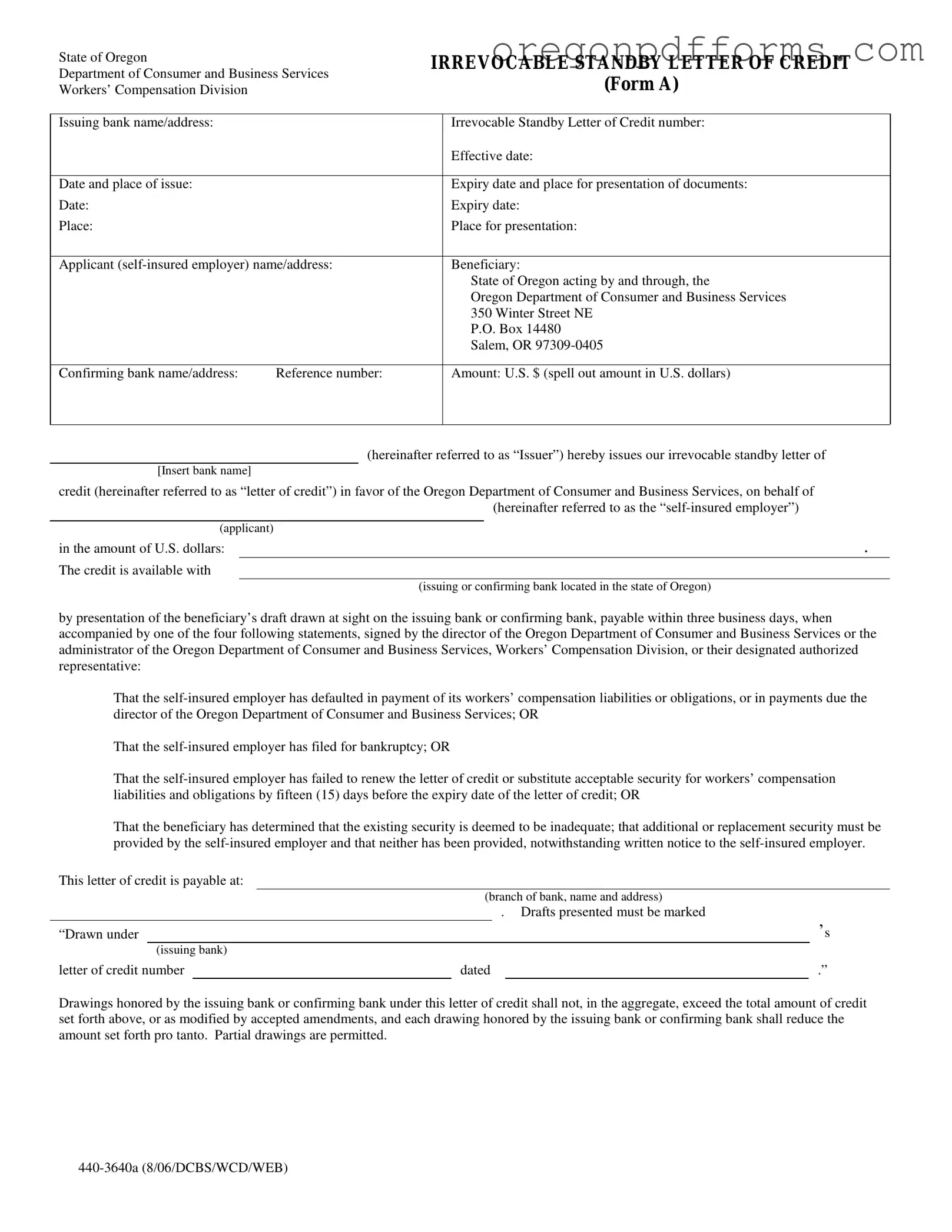

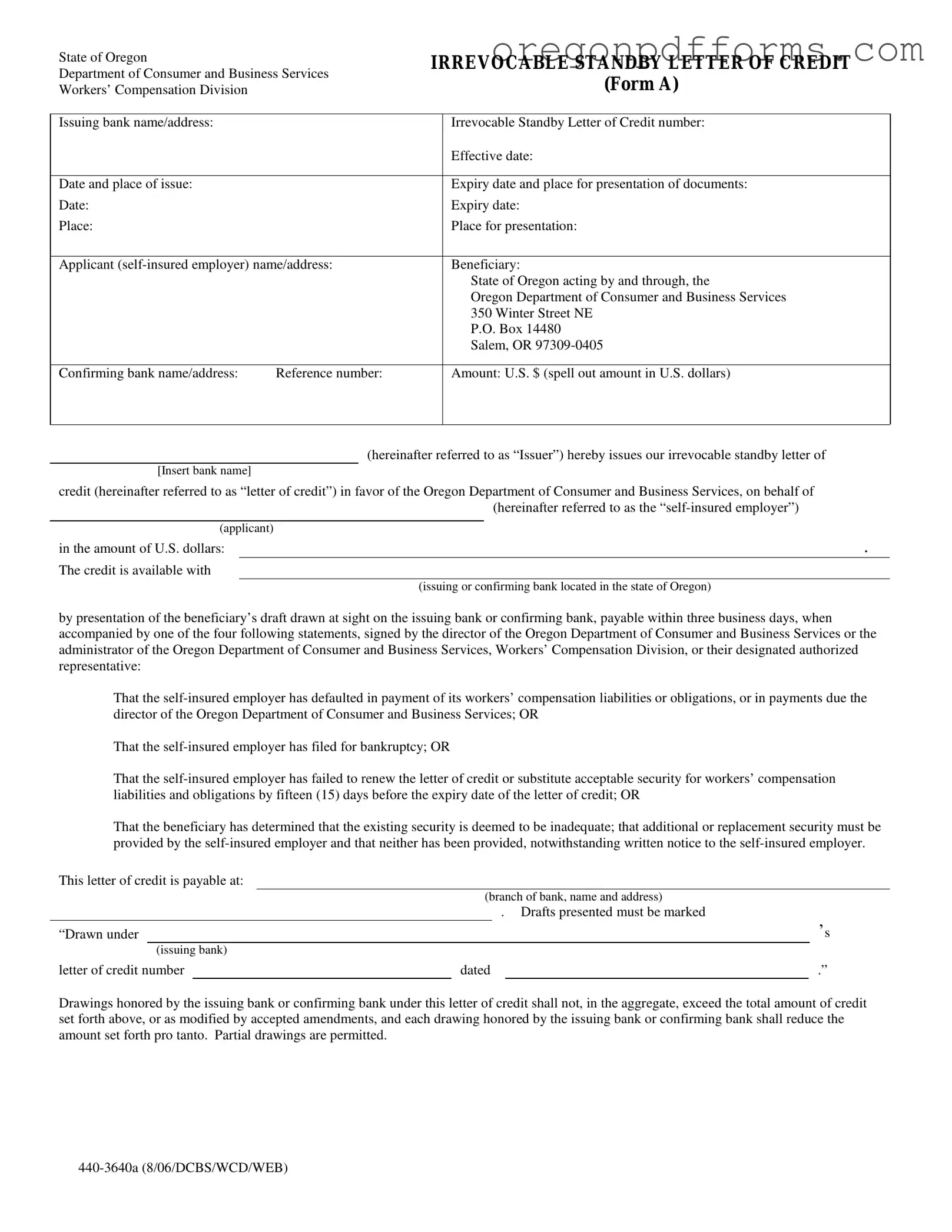

The 440 3640A form is an Irrevocable Standby Letter of Credit used by self-insured employers in Oregon. It serves as a financial guarantee to the Oregon Department of Consumer and Business Services for workers' compensation liabilities. This ensures that funds are available to cover any obligations that the self-insured employer may have.

The applicant is the self-insured employer who is seeking to provide a financial guarantee through the letter of credit. This entity is responsible for ensuring that the terms of the letter of credit are met and that the necessary amounts are available to cover any potential claims.

To complete the 440 3640A form, you will need to provide the following information:

-

Issuing bank name and address

-

Irrevocable Standby Letter of Credit number

-

Effective date and expiry date

-

Applicant's name and address

-

Beneficiary's information (Oregon Department of Consumer and Business Services)

-

Amount of the letter of credit, spelled out in U.S. dollars

How does the payment process work under this letter of credit?

Payments under the letter of credit are made by the issuing or confirming bank upon presentation of a draft by the beneficiary. The draft must be accompanied by one of the specified statements regarding the self-insured employer's obligations. Payments are made by wire transfer to the Oregon Department of Consumer and Business Services’ bank account as instructed in the demand notice.

What happens if the self-insured employer defaults?

If the self-insured employer defaults on its workers' compensation liabilities, the Oregon Department of Consumer and Business Services can draw on the letter of credit. This process ensures that funds are available to cover any outstanding obligations without delay.

Can the letter of credit be amended?

Yes, amendments to the letter of credit can be made. However, any changes must be approved by the beneficiary, which is the Oregon Department of Consumer and Business Services. It is important to ensure that any amendments comply with the requirements set forth in the original letter of credit.

What is the duration of the letter of credit?

The letter of credit is automatically extended for one year from the expiry date unless the issuing bank notifies the beneficiary at least 60 days prior to expiry that it will not extend the letter. This automatic renewal helps ensure continuous coverage for the self-insured employer's obligations.

What are the consequences of not renewing the letter of credit?

If the self-insured employer fails to renew the letter of credit or substitute acceptable security by 15 days before the expiry date, the Oregon Department of Consumer and Business Services may draw on the letter of credit. This is to ensure that funds are available to cover any liabilities that may arise.

Are there any fees associated with the letter of credit?

Yes, all bank charges related to the letter of credit are the responsibility of the applicant. It is essential for the self-insured employer to be aware of these costs and factor them into their financial planning.

What legal jurisdiction applies to this letter of credit?

The letter of credit is subject to the laws of the state of Oregon. In the event of any legal disputes regarding the letter, the proceedings will take place in Oregon courts, ensuring that state laws govern the agreement.