Free 530 Oregon Form

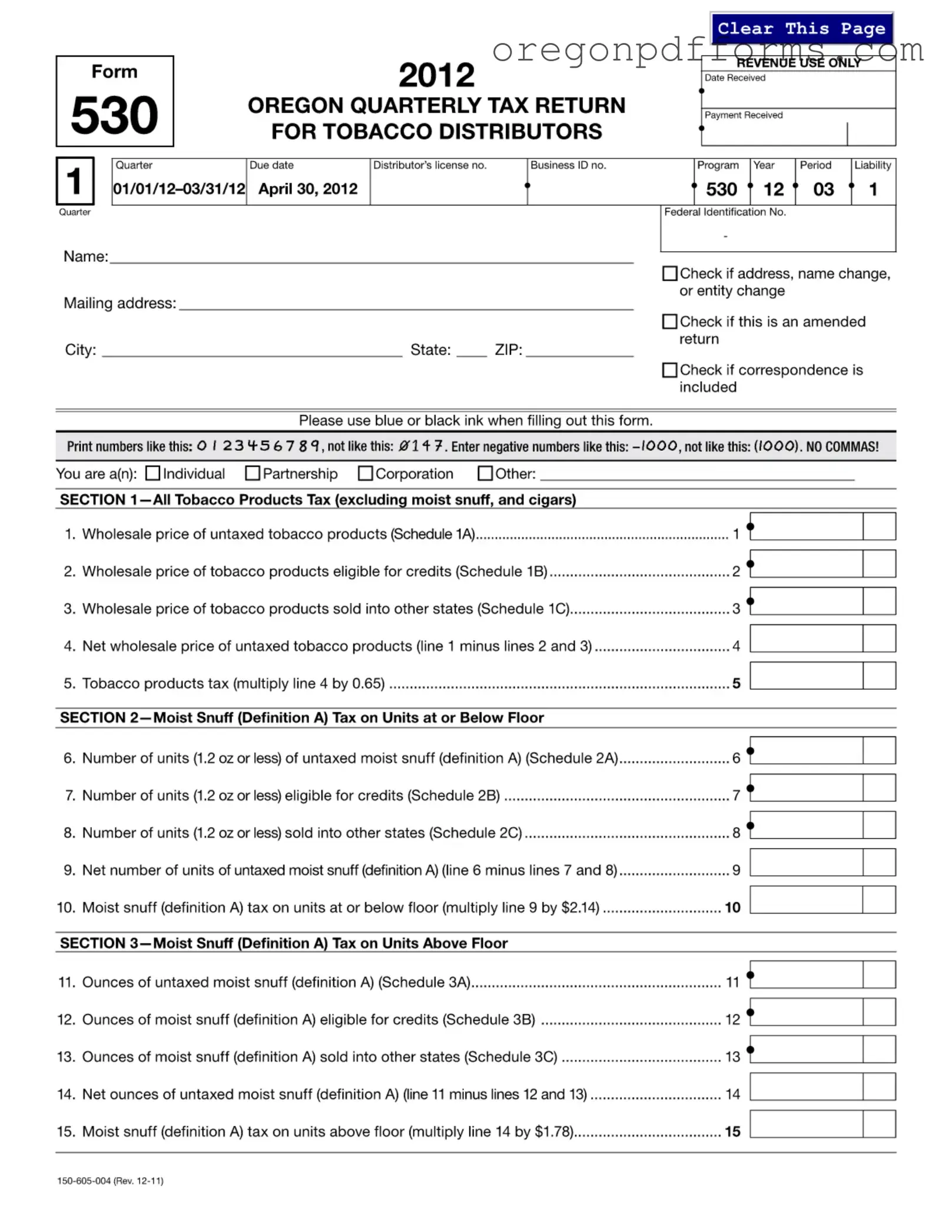

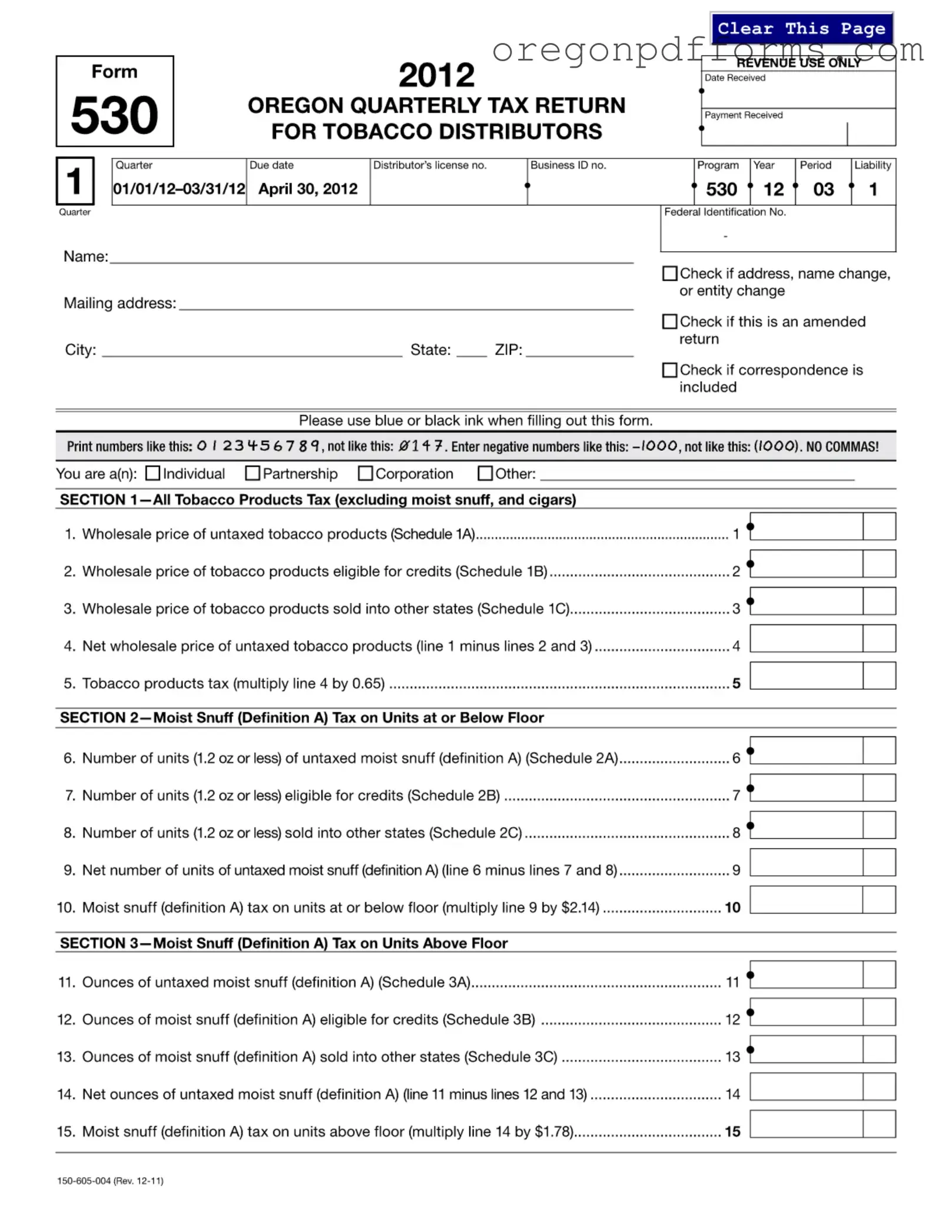

The 530 Oregon Quarterly Tax Return for Tobacco Distributors is a crucial form used by tobacco distributors in Oregon to report their quarterly tax liabilities. This form ensures that businesses comply with state tax regulations by detailing the sales and taxes associated with various tobacco products, including cigars and moist snuff. Understanding how to accurately complete this form is essential for maintaining compliance and avoiding penalties.

Open My 530 Oregon

Free 530 Oregon Form

Open My 530 Oregon

Open My 530 Oregon

or

Get PDF

A few steps left to finish this form

Complete 530 Oregon online with easy edits and saving.