Free 65 Oregon Form

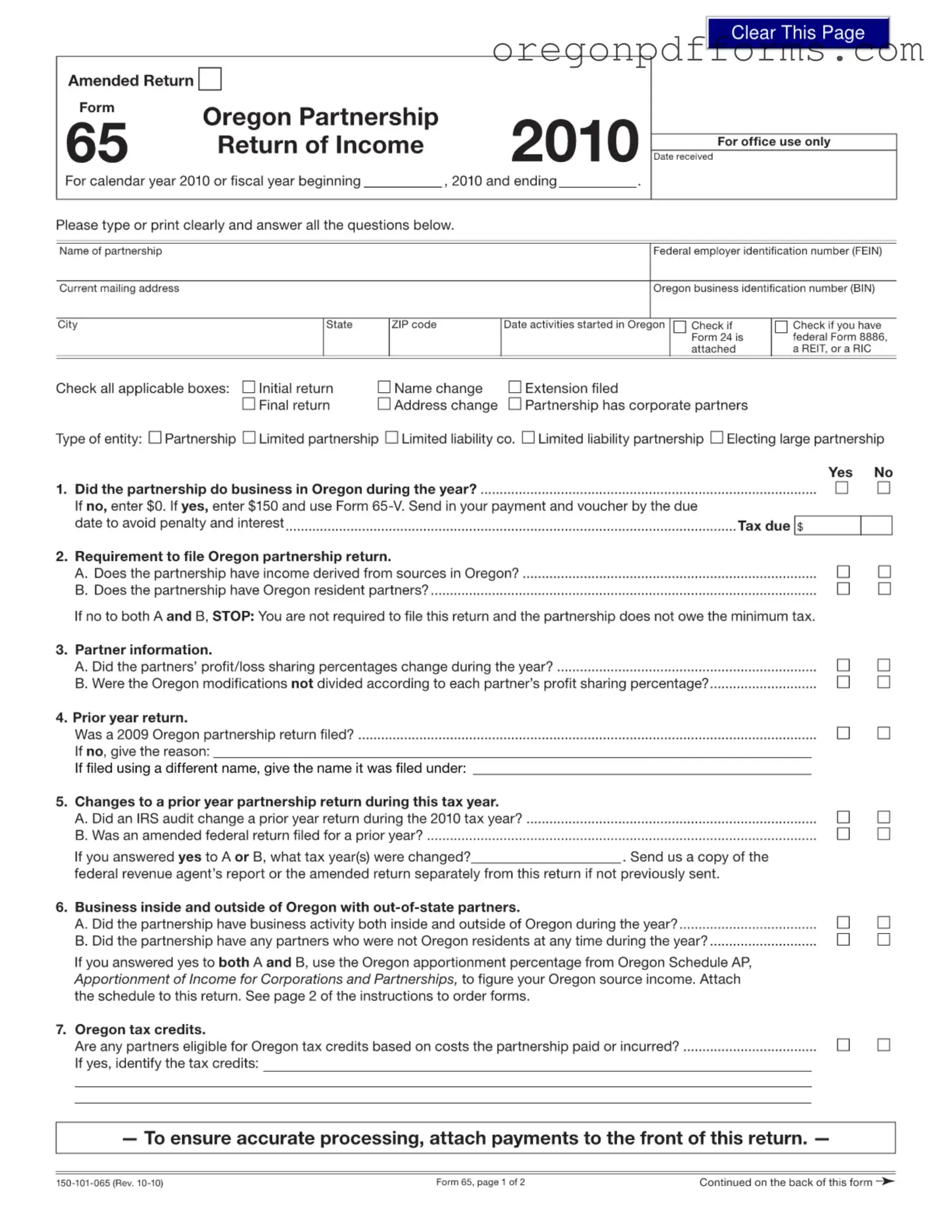

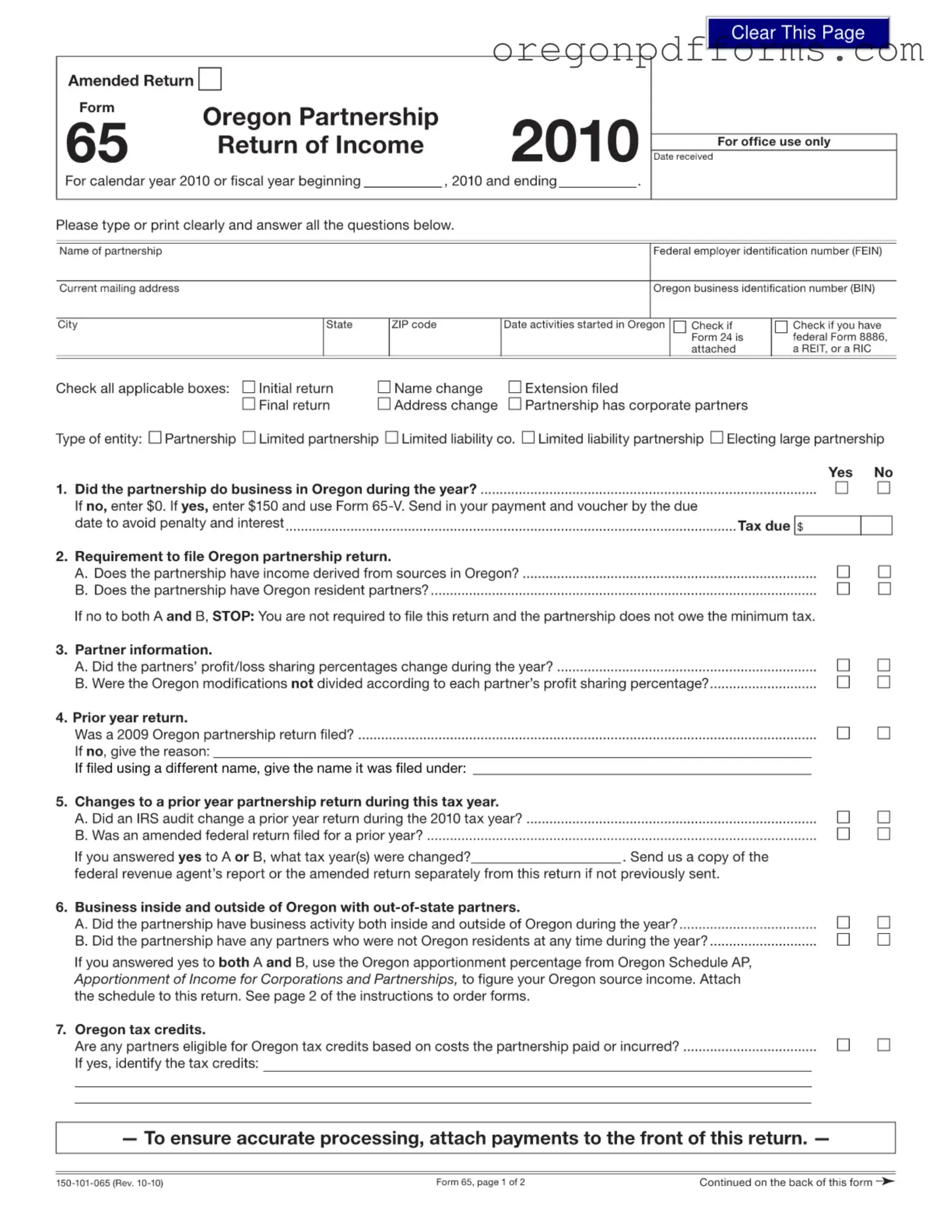

The 65 Oregon form is a tax document used by partnerships to report their income and activities in Oregon. This form is necessary for partnerships that have income derived from Oregon sources or have Oregon resident partners. Completing the 65 Oregon form accurately ensures compliance with state tax regulations and helps determine any tax obligations for the partnership.

Open My 65 Oregon

Free 65 Oregon Form

Open My 65 Oregon

Open My 65 Oregon

or

Get PDF

A few steps left to finish this form

Complete 65 Oregon online with easy edits and saving.