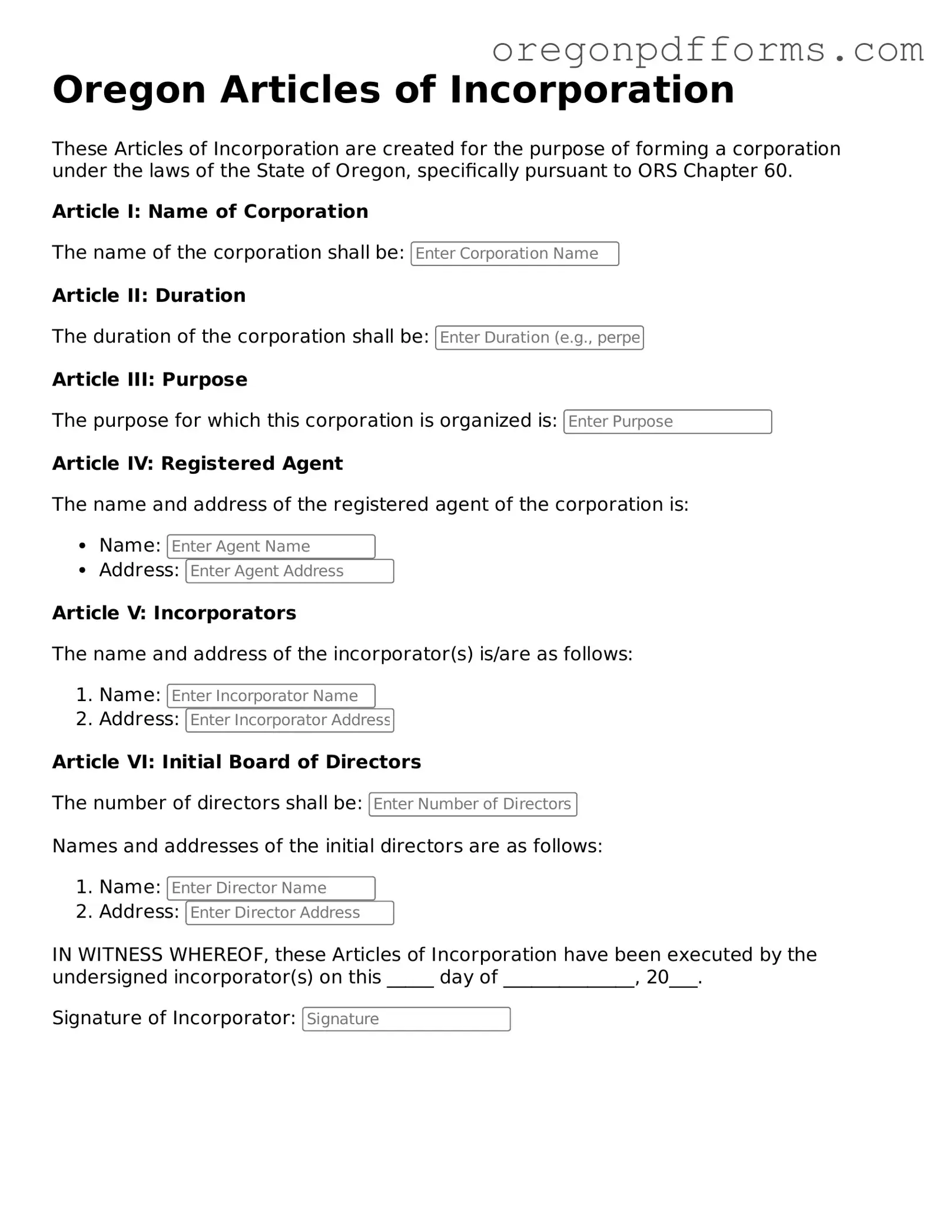

What are the Oregon Articles of Incorporation?

The Oregon Articles of Incorporation is a legal document that establishes a corporation in the state of Oregon. This form outlines essential details about the corporation, such as its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this document is a crucial first step in the incorporation process.

Who needs to file the Articles of Incorporation?

Any individual or group looking to start a corporation in Oregon must file the Articles of Incorporation. This includes businesses of various types, such as for-profit corporations, non-profit organizations, and professional corporations. If you want your business to be recognized as a separate legal entity, filing this form is necessary.

What information is required in the Articles of Incorporation?

The Articles of Incorporation typically require the following information:

-

Name of the corporation

-

Principal office address

-

Name and address of the registered agent

-

Purpose of the corporation

-

Number of shares authorized to issue

-

Names and addresses of the incorporators

Providing accurate and complete information is essential to ensure your application is processed smoothly.

How do I file the Articles of Incorporation in Oregon?

To file the Articles of Incorporation in Oregon, you can complete the form online through the Oregon Secretary of State's website or submit a paper form by mail. If filing online, you will need to create an account. For paper submissions, ensure you send the completed form along with the required filing fee to the appropriate address.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in Oregon varies based on the type of corporation you are forming. Generally, the fee ranges from $100 to $275. It's important to check the current fee schedule on the Oregon Secretary of State's website to confirm the exact amount.

How long does it take for the Articles of Incorporation to be processed?

Processing times can vary. Typically, online filings are processed more quickly than paper submissions. You can expect a turnaround time of anywhere from a few days to a couple of weeks. If you need expedited processing, inquire about options available through the Secretary of State’s office.

What happens after I file the Articles of Incorporation?

Once your Articles of Incorporation are filed and approved, your corporation becomes a legal entity. You will receive a certificate of incorporation, which serves as proof of your corporation's existence. After this, you will need to comply with ongoing requirements, such as obtaining an Employer Identification Number (EIN) and filing annual reports.

Can I amend the Articles of Incorporation after filing?

Yes, you can amend the Articles of Incorporation after they have been filed. If changes are needed—such as altering the corporation's name or increasing the number of shares—you must file an amendment form with the Oregon Secretary of State. There may be a fee associated with this amendment process.

Do I need a lawyer to file the Articles of Incorporation?

While it's not required to have a lawyer to file the Articles of Incorporation, consulting with one can be beneficial. A legal professional can help ensure that you meet all requirements and understand the implications of incorporating. If you feel confident in handling the paperwork yourself, you can certainly proceed without legal assistance.

What is the difference between Articles of Incorporation and Bylaws?

The Articles of Incorporation and Bylaws serve different purposes. The Articles of Incorporation establish the corporation's existence and basic structure, while Bylaws outline the internal rules and procedures for managing the corporation. Bylaws cover topics like board meetings, voting procedures, and roles of officers. Both documents are essential for a well-functioning corporation.