Free Bin Oregon Form

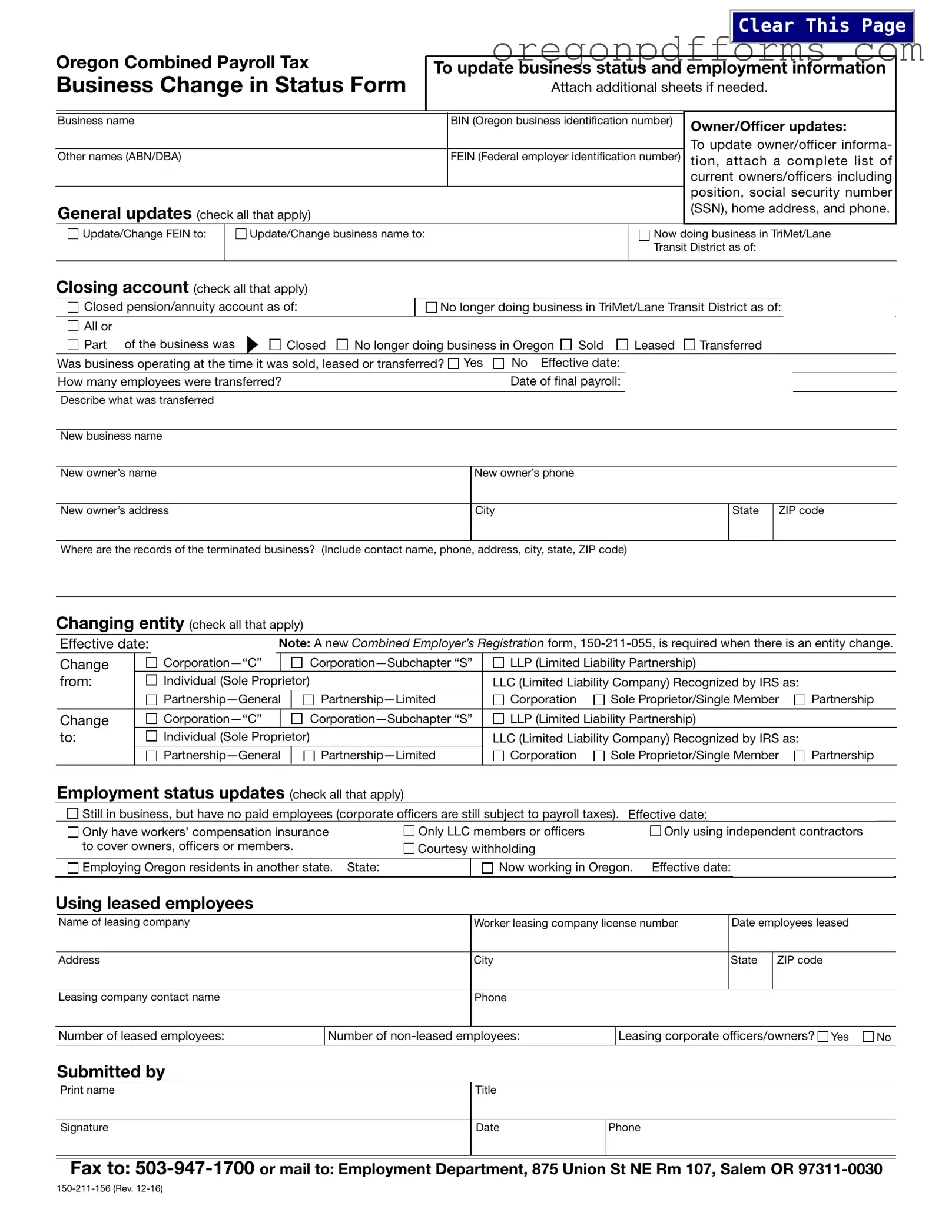

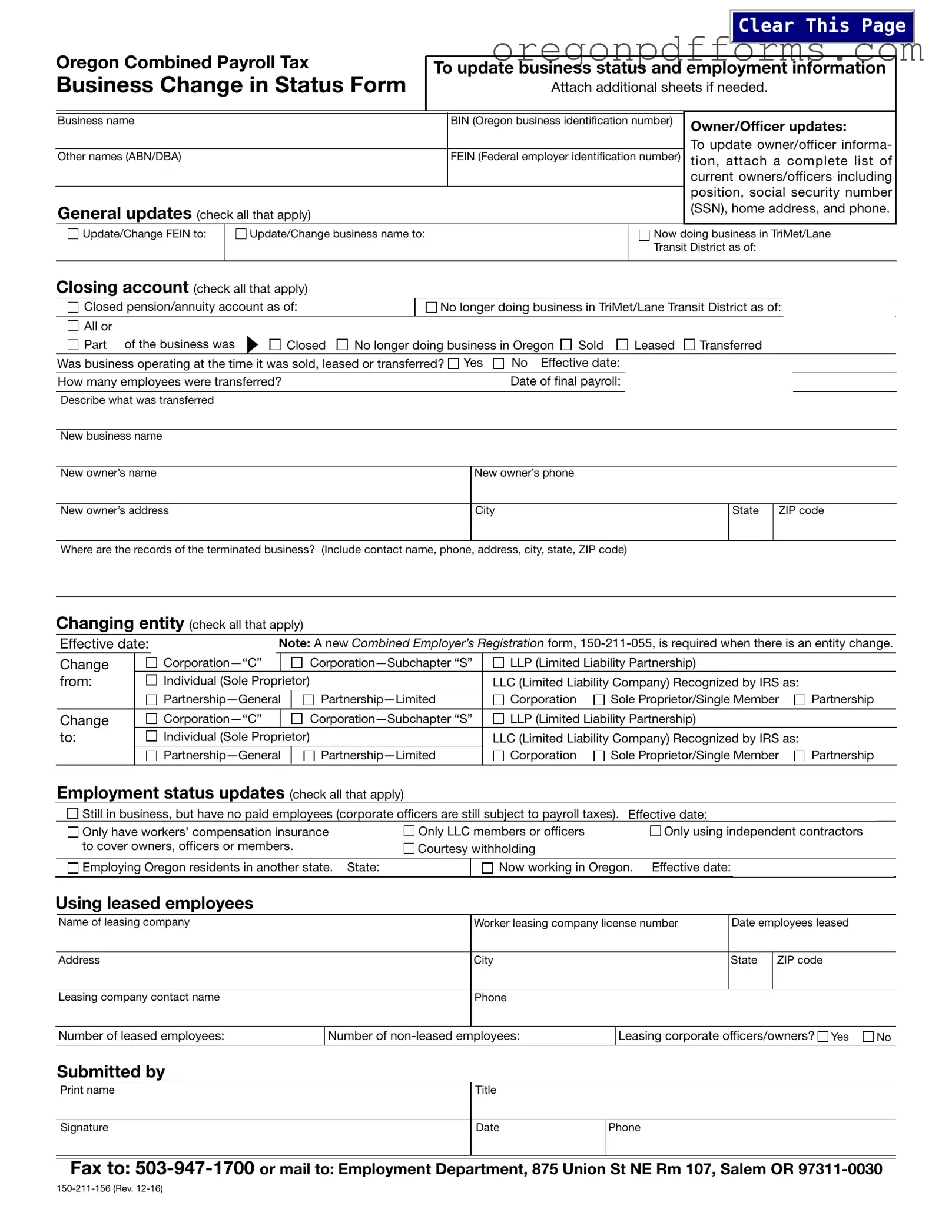

The Bin Oregon form is a document used by businesses in Oregon to report changes in their employment status and business information. This form notifies the Employment Department, the Department of Revenue, and the Department of Consumer and Business Services about updates such as ownership changes, business name alterations, or employment status modifications. Completing this form accurately is essential for maintaining compliance with state regulations.

Open My Bin Oregon

Free Bin Oregon Form

Open My Bin Oregon

Open My Bin Oregon

or

Get PDF

A few steps left to finish this form

Complete Bin Oregon online with easy edits and saving.