Free Oregon 20 S Form

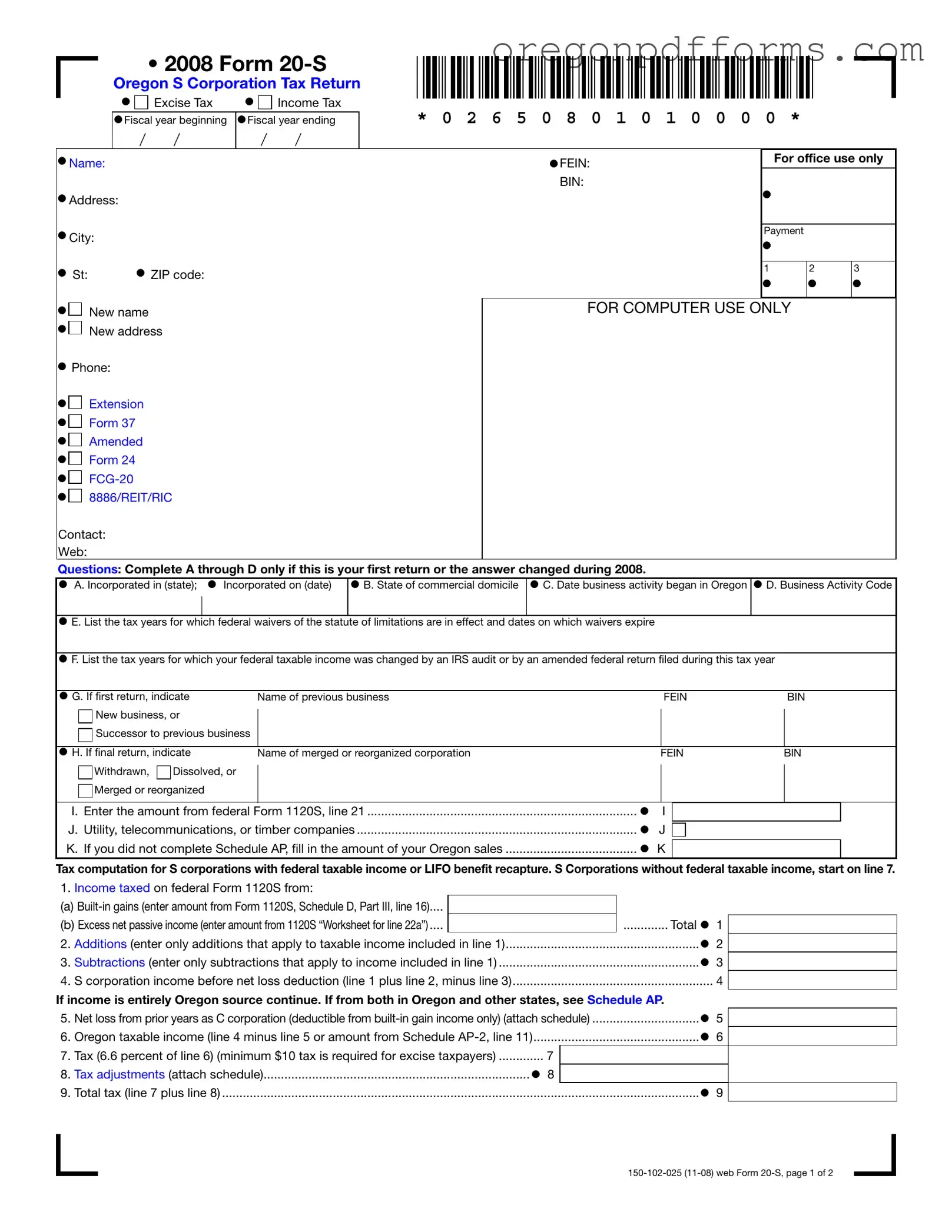

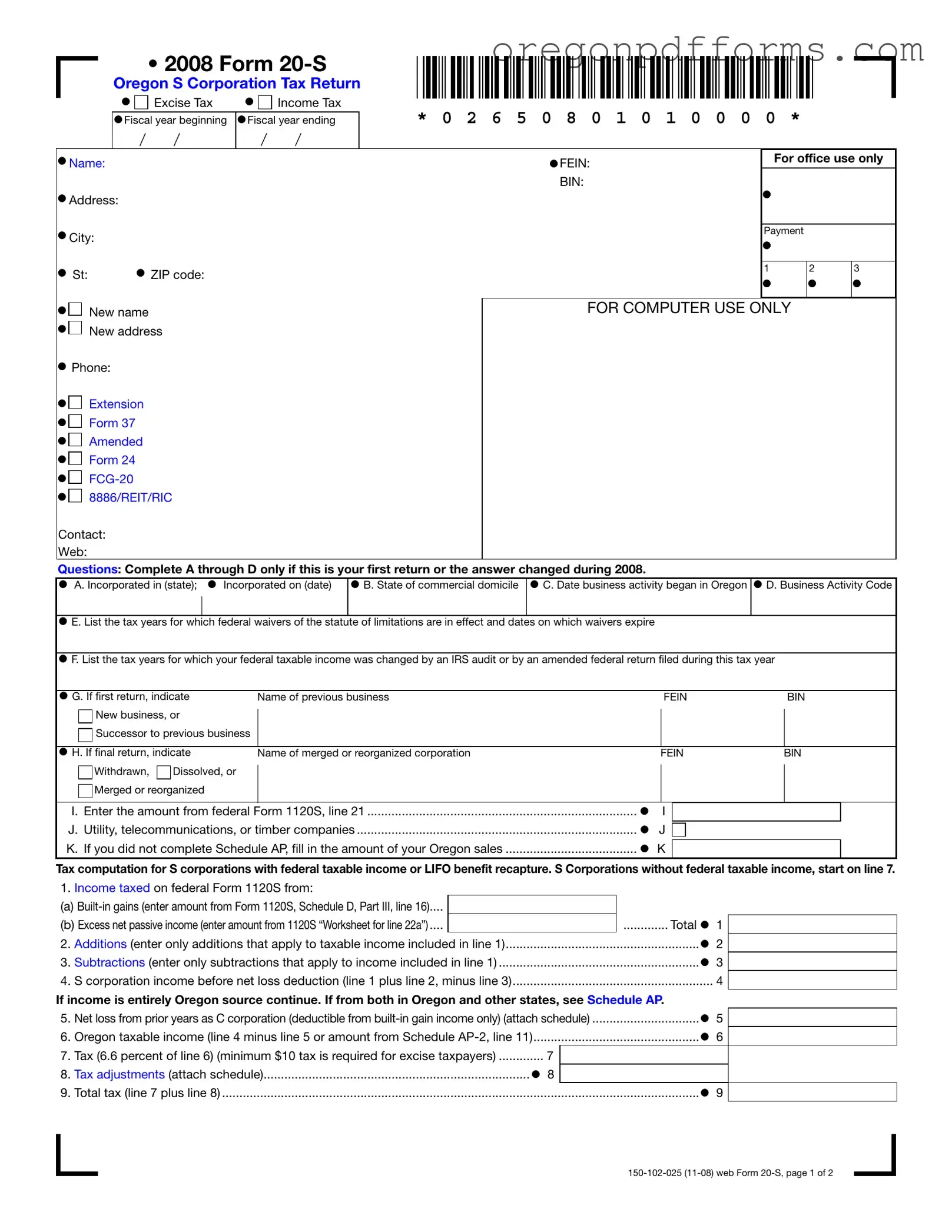

The Oregon 20 S form is the tax return specifically designed for S corporations operating in Oregon. This form is used to report both excise and income taxes for the fiscal year. Understanding how to properly complete and submit the Oregon 20 S form is crucial for compliance and can help avoid unnecessary penalties.

Open My Oregon 20 S

Free Oregon 20 S Form

Open My Oregon 20 S

Open My Oregon 20 S

or

Get PDF

A few steps left to finish this form

Complete Oregon 20 S online with easy edits and saving.