Free Oregon 20 V Form

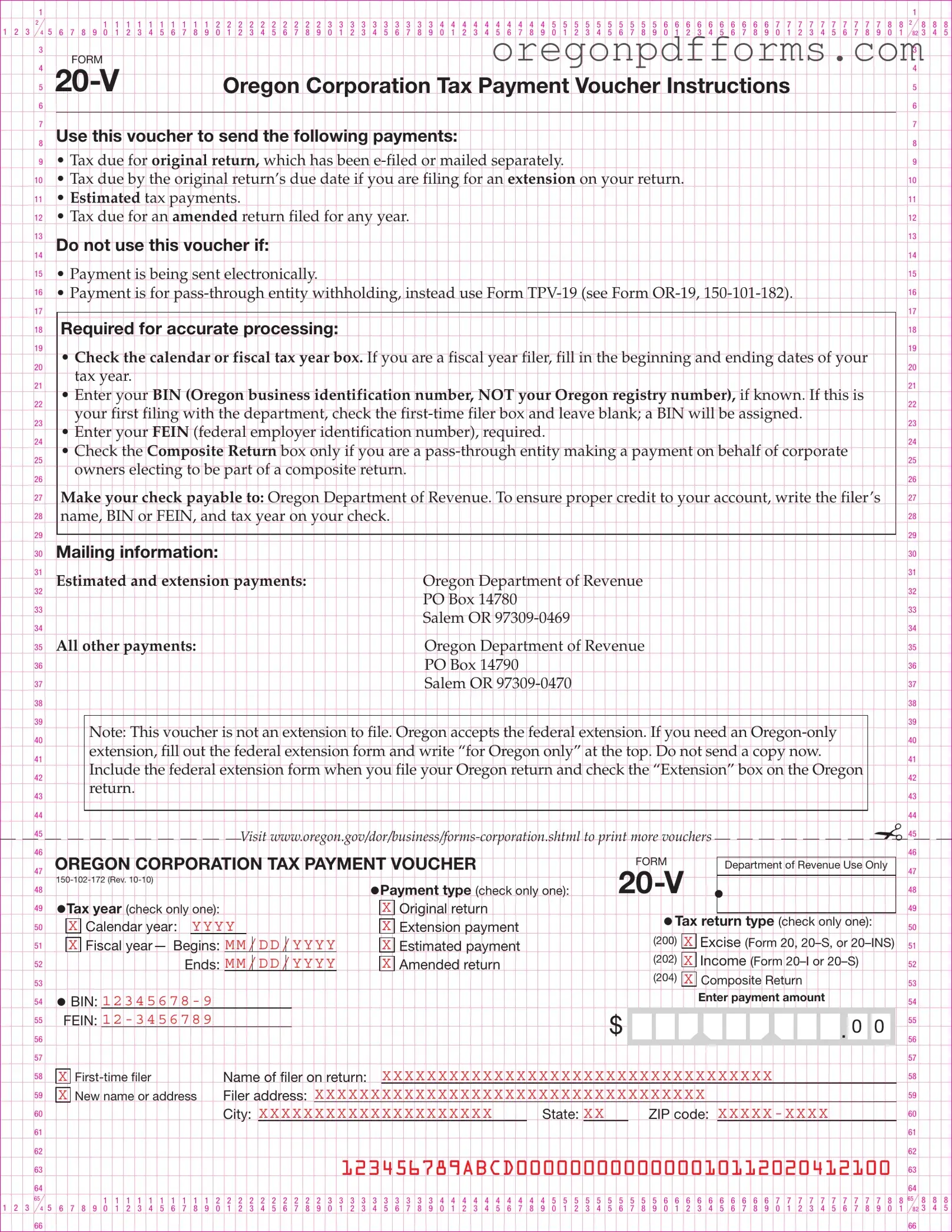

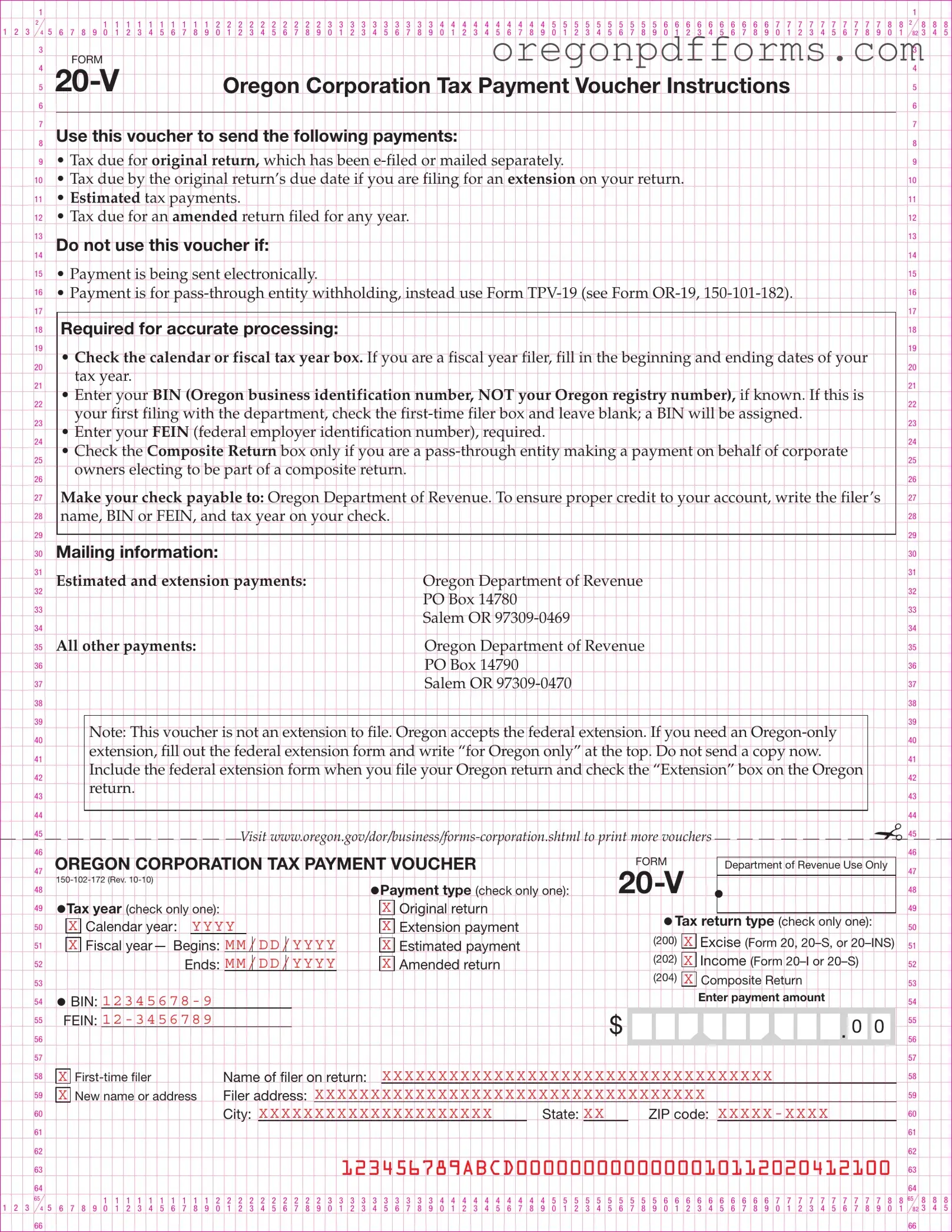

The Oregon 20 V form is a payment voucher used for submitting various tax payments to the Oregon Department of Revenue. This form is essential for businesses that need to remit taxes due for original returns, estimated payments, or amended returns. Understanding how to complete and submit this form accurately can help ensure timely processing and compliance with state tax regulations.

Open My Oregon 20 V

Free Oregon 20 V Form

Open My Oregon 20 V

Open My Oregon 20 V

or

Get PDF

A few steps left to finish this form

Complete Oregon 20 V online with easy edits and saving.