Free Oregon 2553 Form

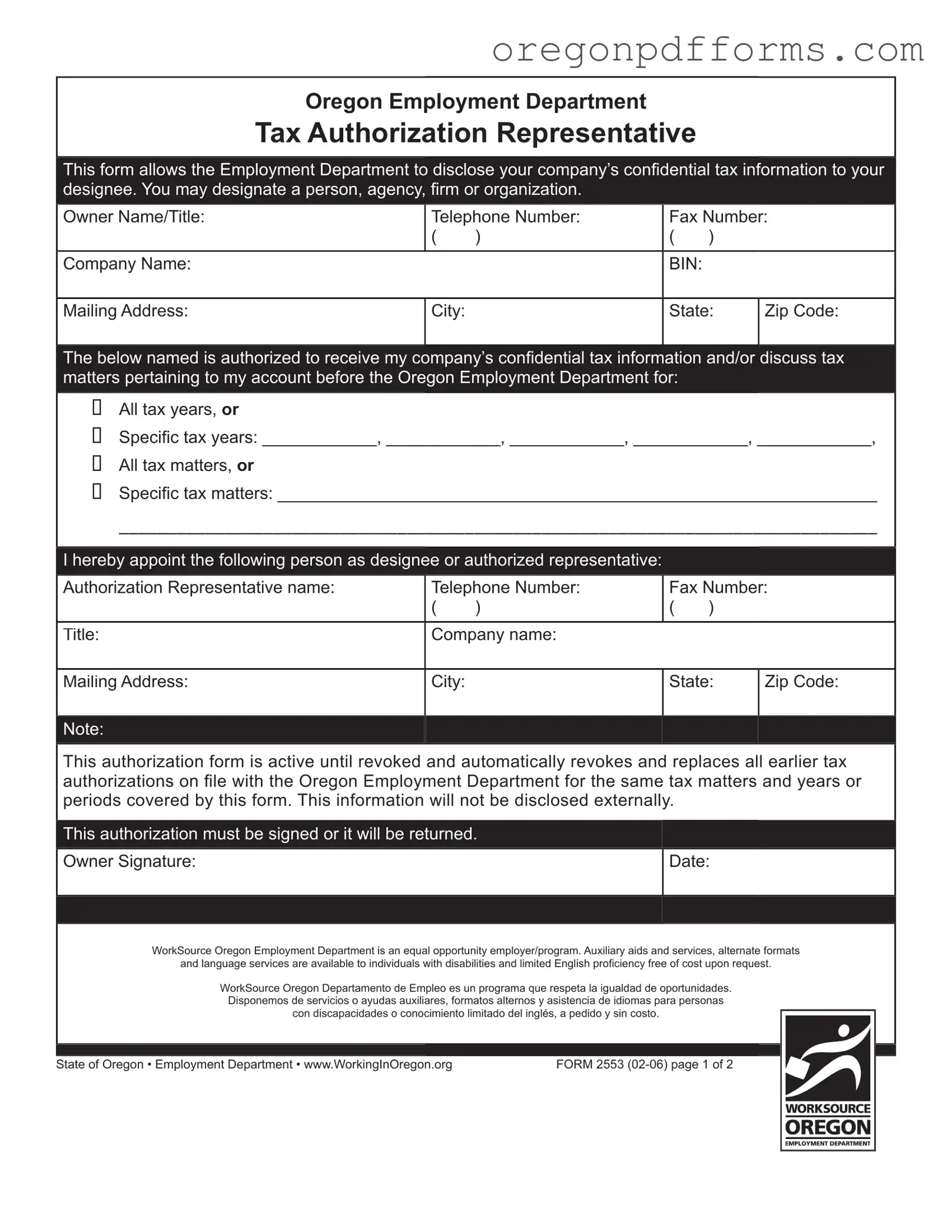

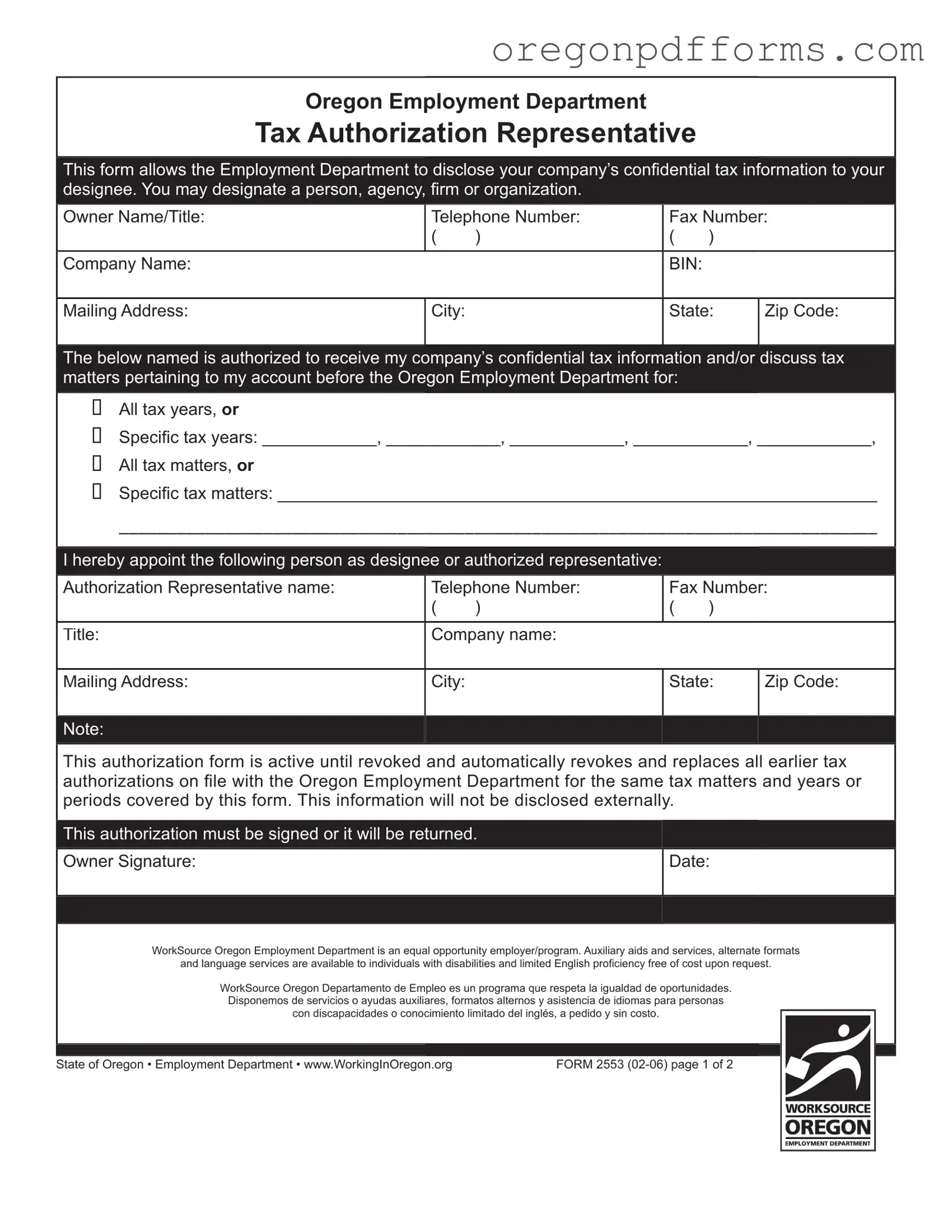

The Oregon 2553 form is a document that allows the Oregon Employment Department to share your company's confidential tax information with a designated representative. This form can authorize an individual, agency, or organization to discuss tax matters on your behalf. It is essential for businesses seeking to streamline communication regarding their tax accounts with the Employment Department.

Open My Oregon 2553

Free Oregon 2553 Form

Open My Oregon 2553

Open My Oregon 2553

or

Get PDF

A few steps left to finish this form

Complete Oregon 2553 online with easy edits and saving.