Free Oregon 40 Ext Form

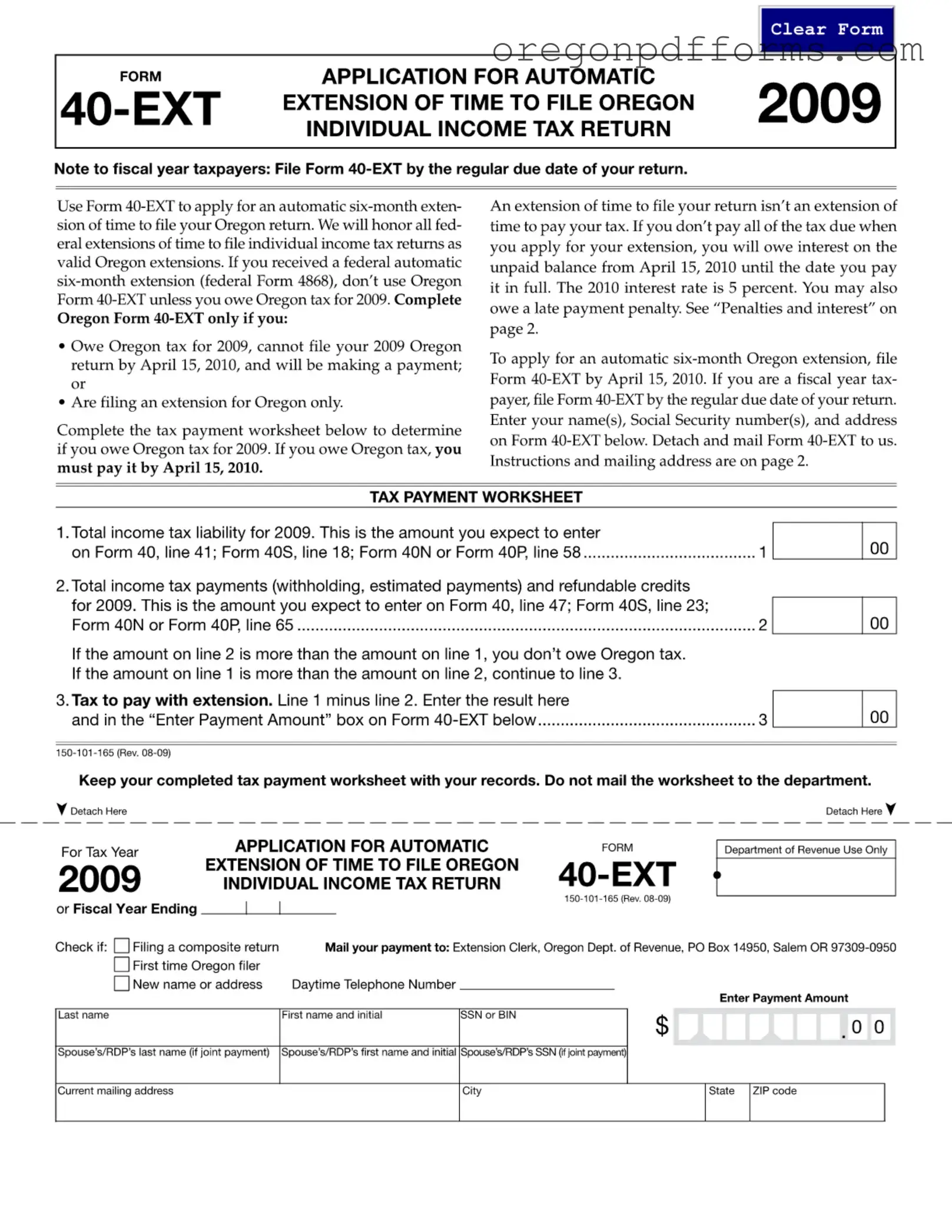

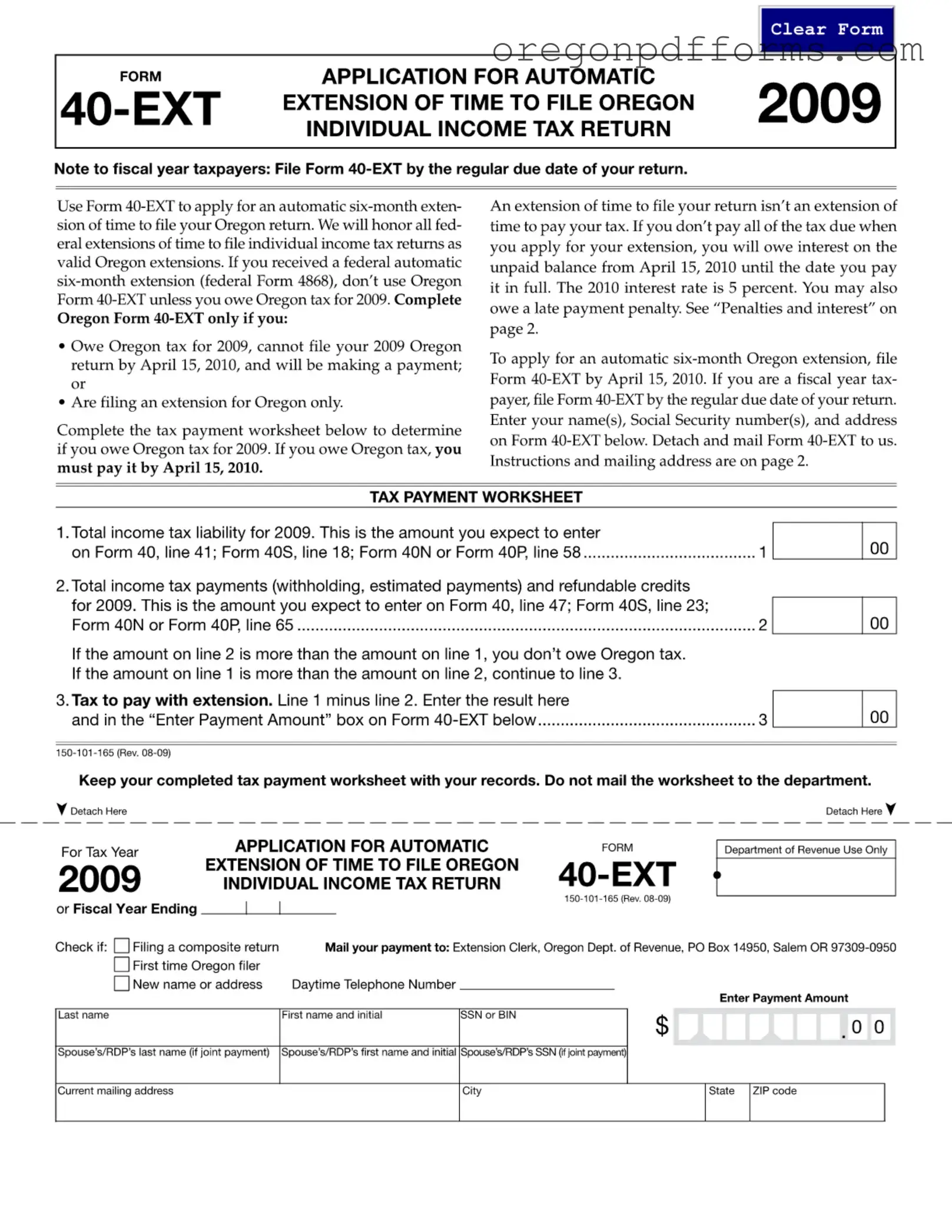

The Oregon 40 Ext form is an application for an automatic six-month extension of time to file your Oregon individual income tax return. Taxpayers who owe Oregon tax and cannot file by the due date must complete this form to avoid penalties. It is essential to understand that an extension to file does not extend the time to pay any taxes owed.

Open My Oregon 40 Ext

Free Oregon 40 Ext Form

Open My Oregon 40 Ext

Open My Oregon 40 Ext

or

Get PDF

A few steps left to finish this form

Complete Oregon 40 Ext online with easy edits and saving.