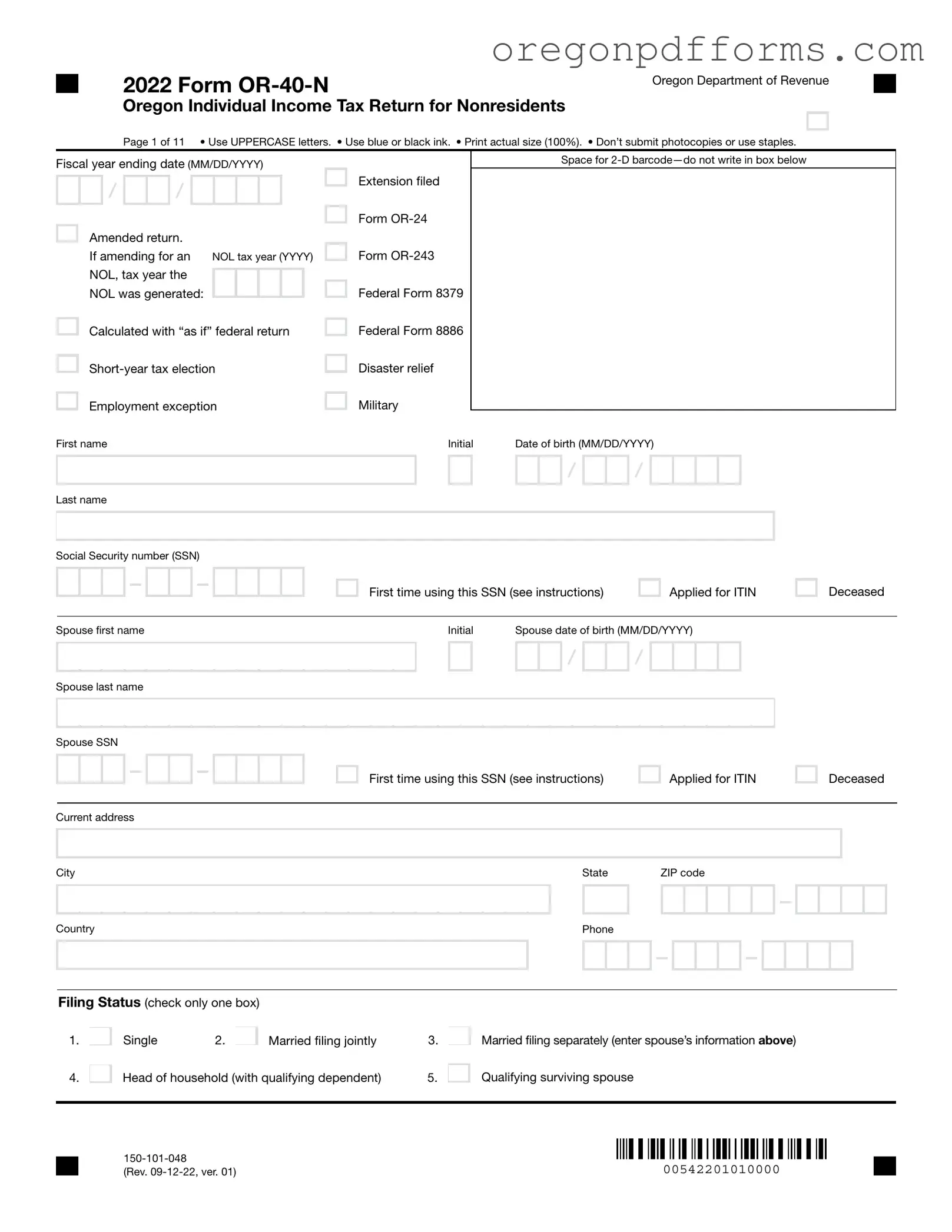

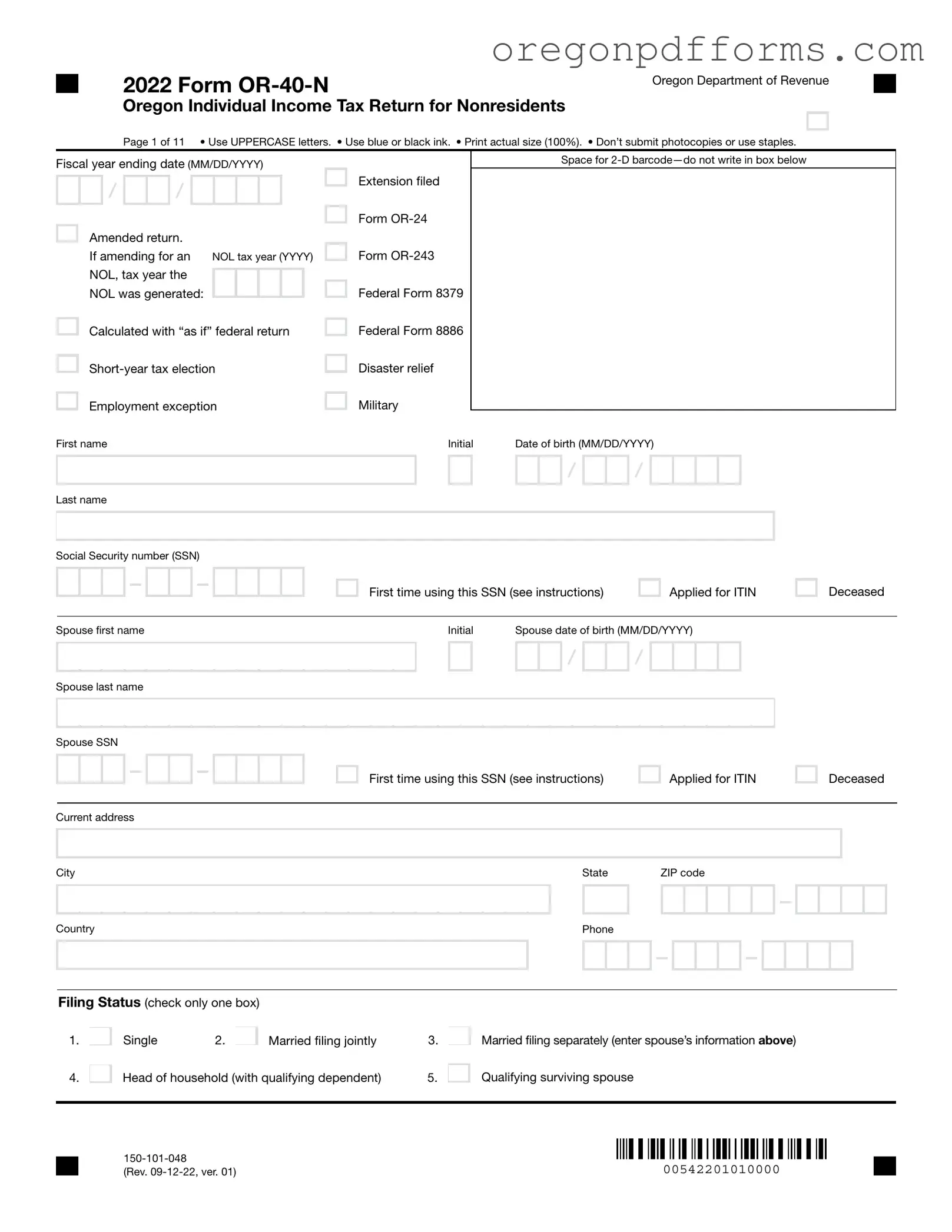

Free Oregon 40N Form

The Oregon 40N form is the official tax return document for nonresidents filing their individual income taxes in Oregon. This form is essential for accurately reporting income earned in the state, as well as determining tax liabilities and potential refunds. Understanding how to complete the Oregon 40N can help ensure compliance with state tax laws and maximize any eligible credits or deductions.

Open My Oregon 40N

Free Oregon 40N Form

Open My Oregon 40N

Open My Oregon 40N

or

Get PDF

A few steps left to finish this form

Complete Oregon 40N online with easy edits and saving.