Free Oregon 40V Form

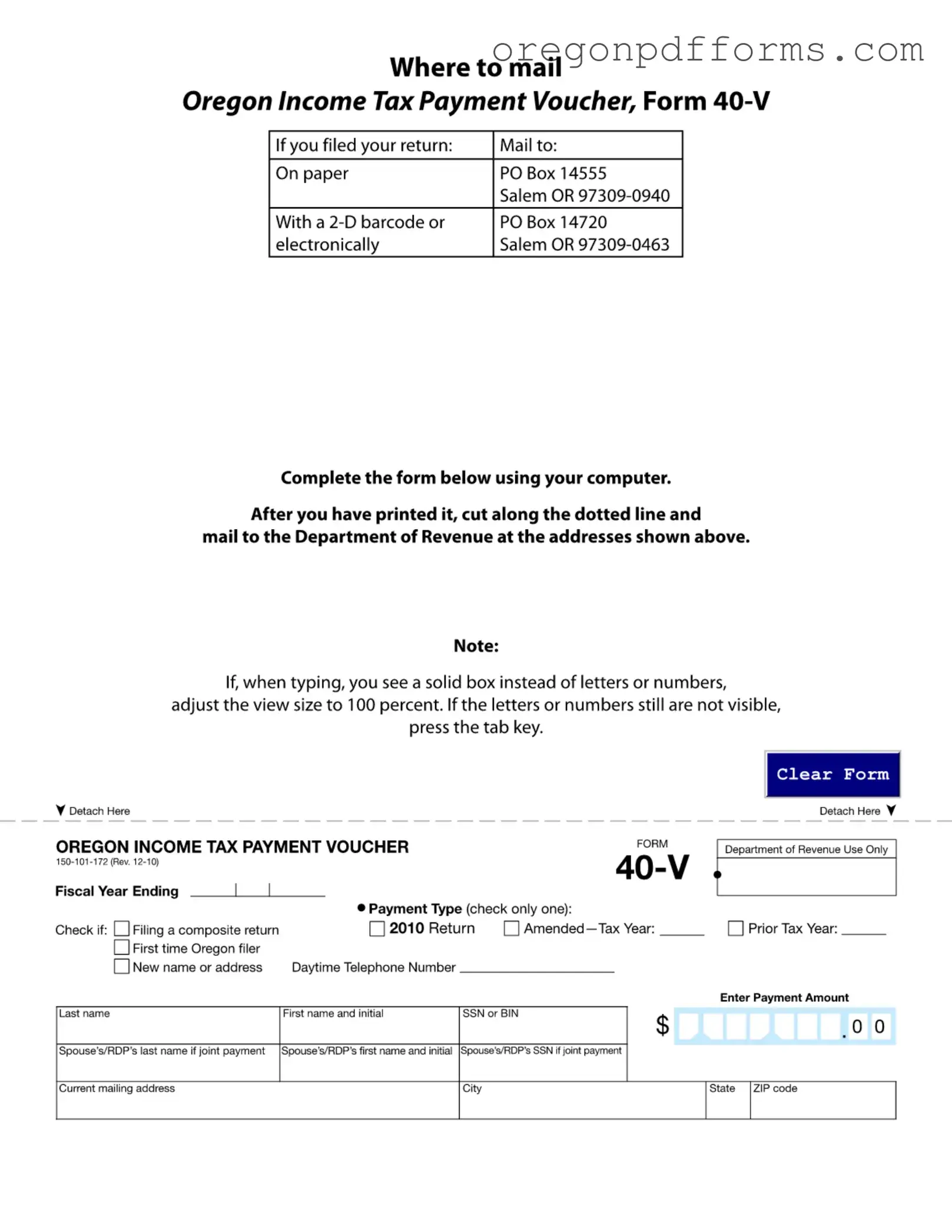

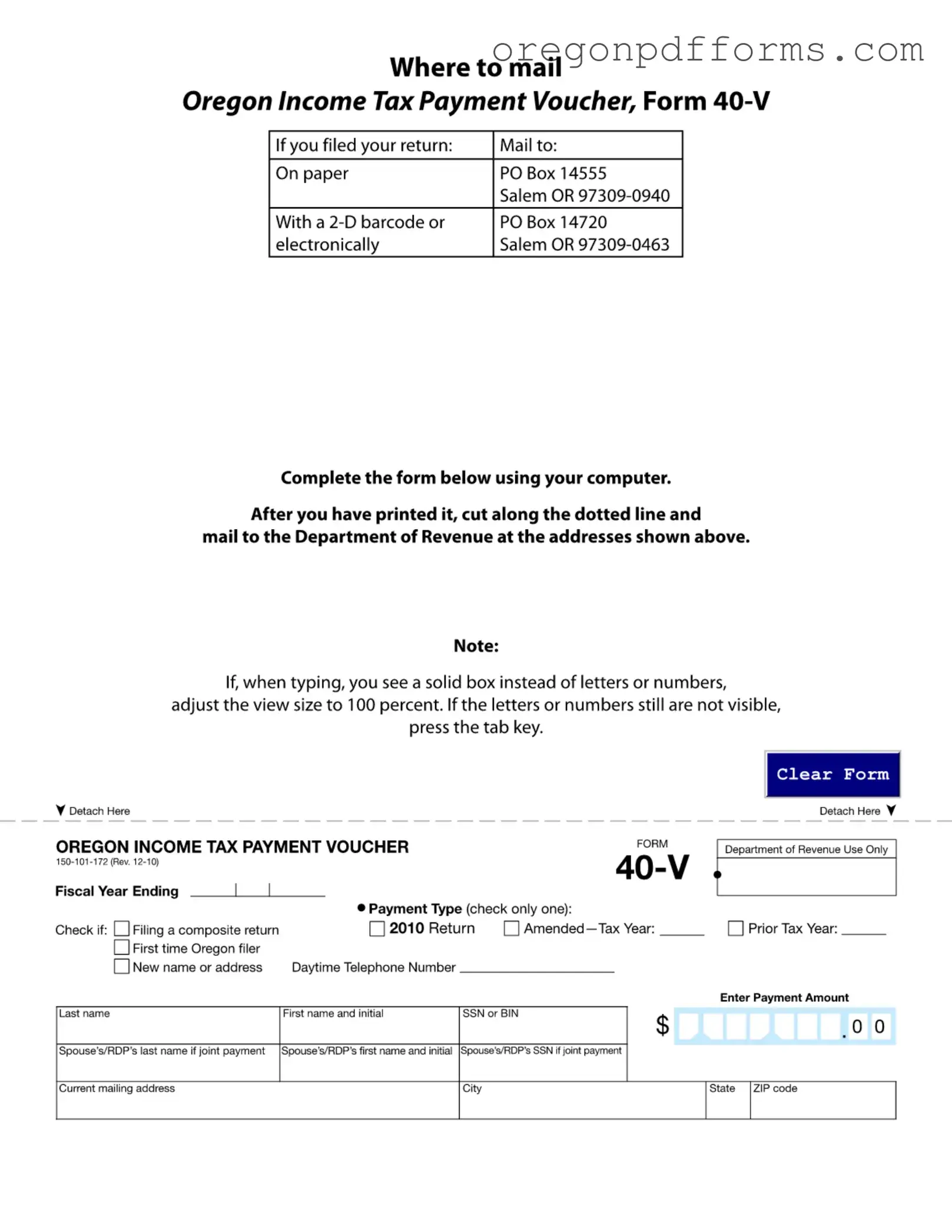

The Oregon 40V form serves as the state’s Income Tax Payment Voucher, designed to facilitate the payment of taxes owed. Taxpayers must complete this form accurately and send it to the appropriate Department of Revenue address, depending on how they filed their return. Understanding the requirements and proper submission process is essential for ensuring compliance and avoiding potential penalties.

Open My Oregon 40V

Free Oregon 40V Form

Open My Oregon 40V

Open My Oregon 40V

or

Get PDF

A few steps left to finish this form

Complete Oregon 40V online with easy edits and saving.