Free Oregon Ds1 Form

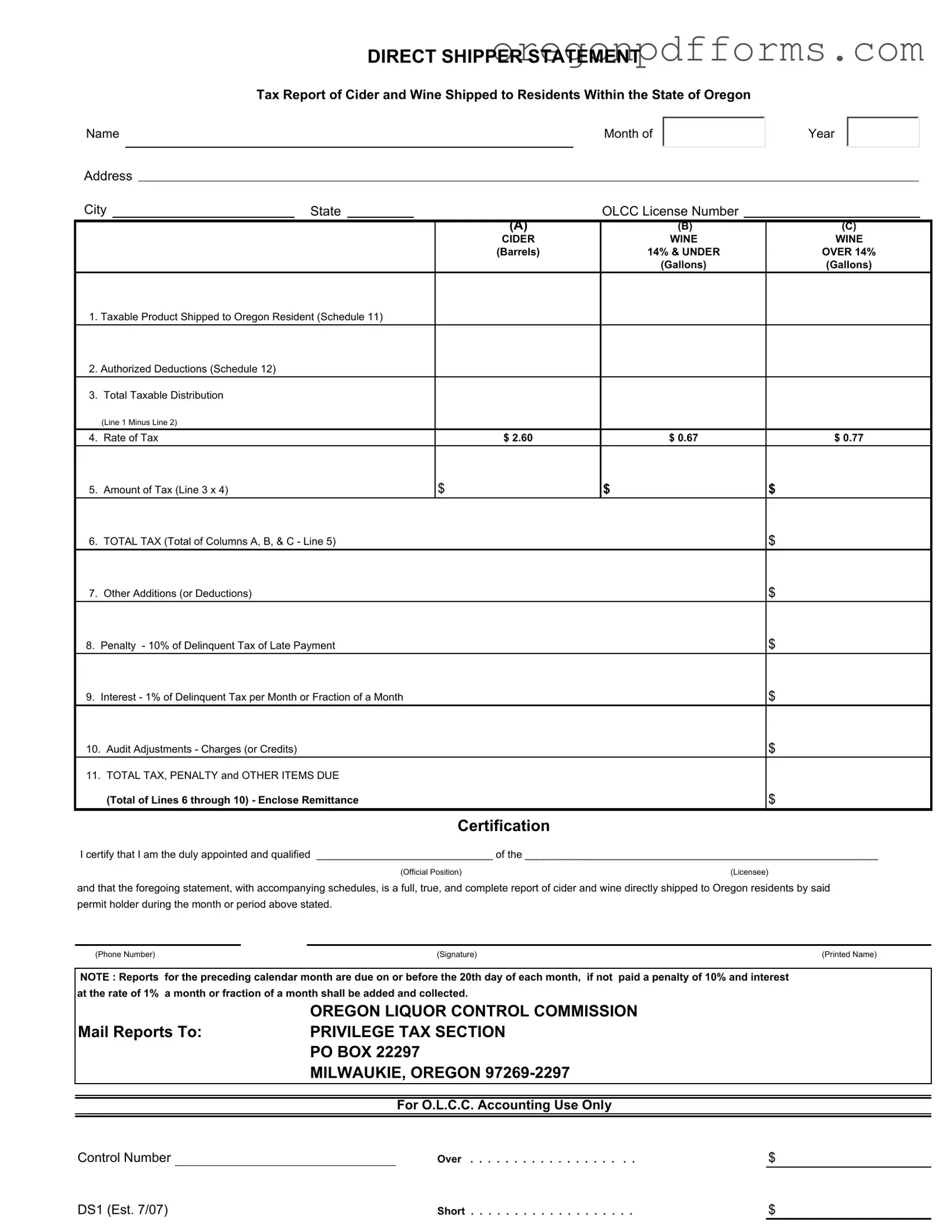

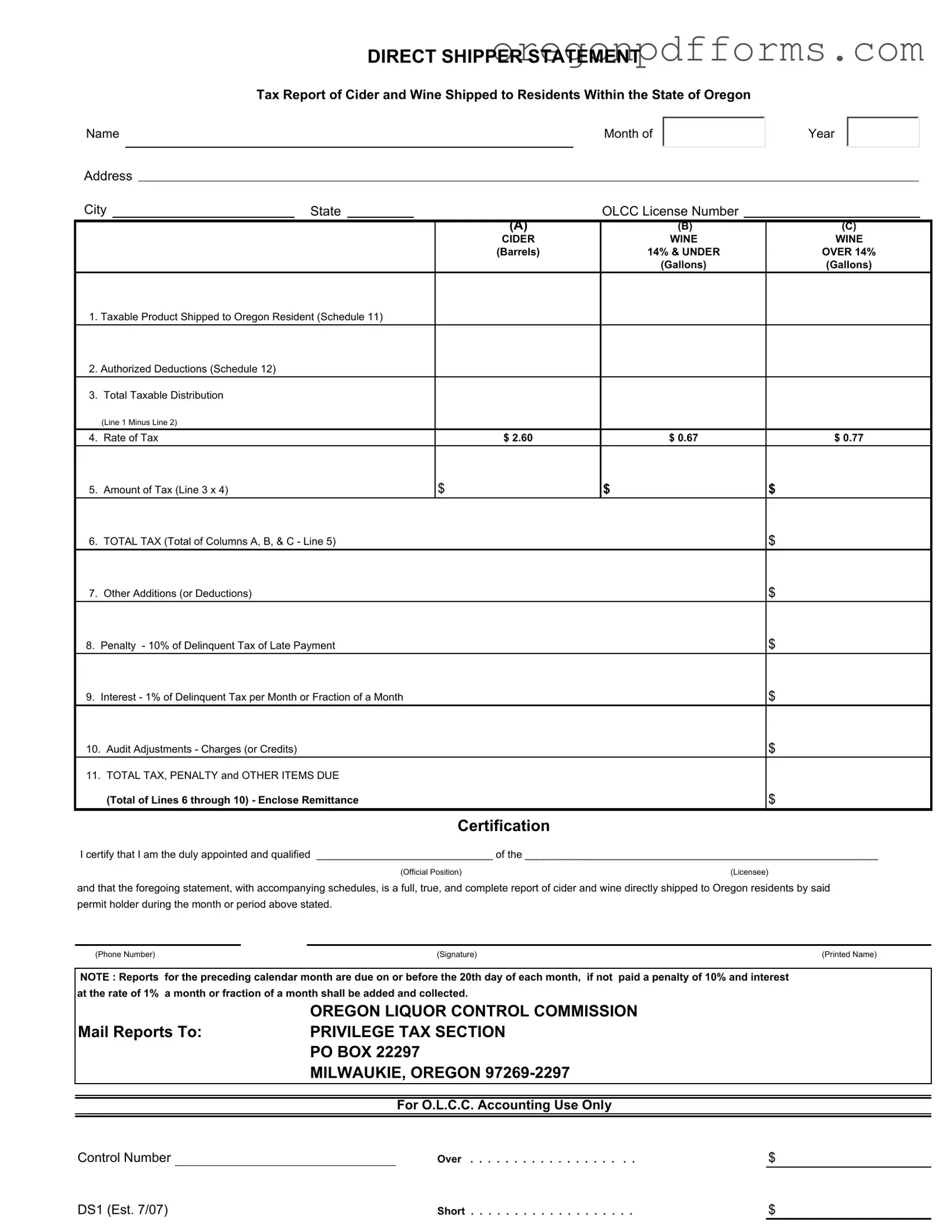

The Oregon DS1 form is a crucial document used by direct shippers to report the shipment of cider and wine to residents within the state of Oregon. This form captures essential information such as the total taxable product shipped, authorized deductions, and the resulting tax obligations. Timely submission of the DS1 form ensures compliance with state regulations and helps avoid penalties associated with late reporting.

Open My Oregon Ds1

Free Oregon Ds1 Form

Open My Oregon Ds1

Open My Oregon Ds1

or

Get PDF

A few steps left to finish this form

Complete Oregon Ds1 online with easy edits and saving.