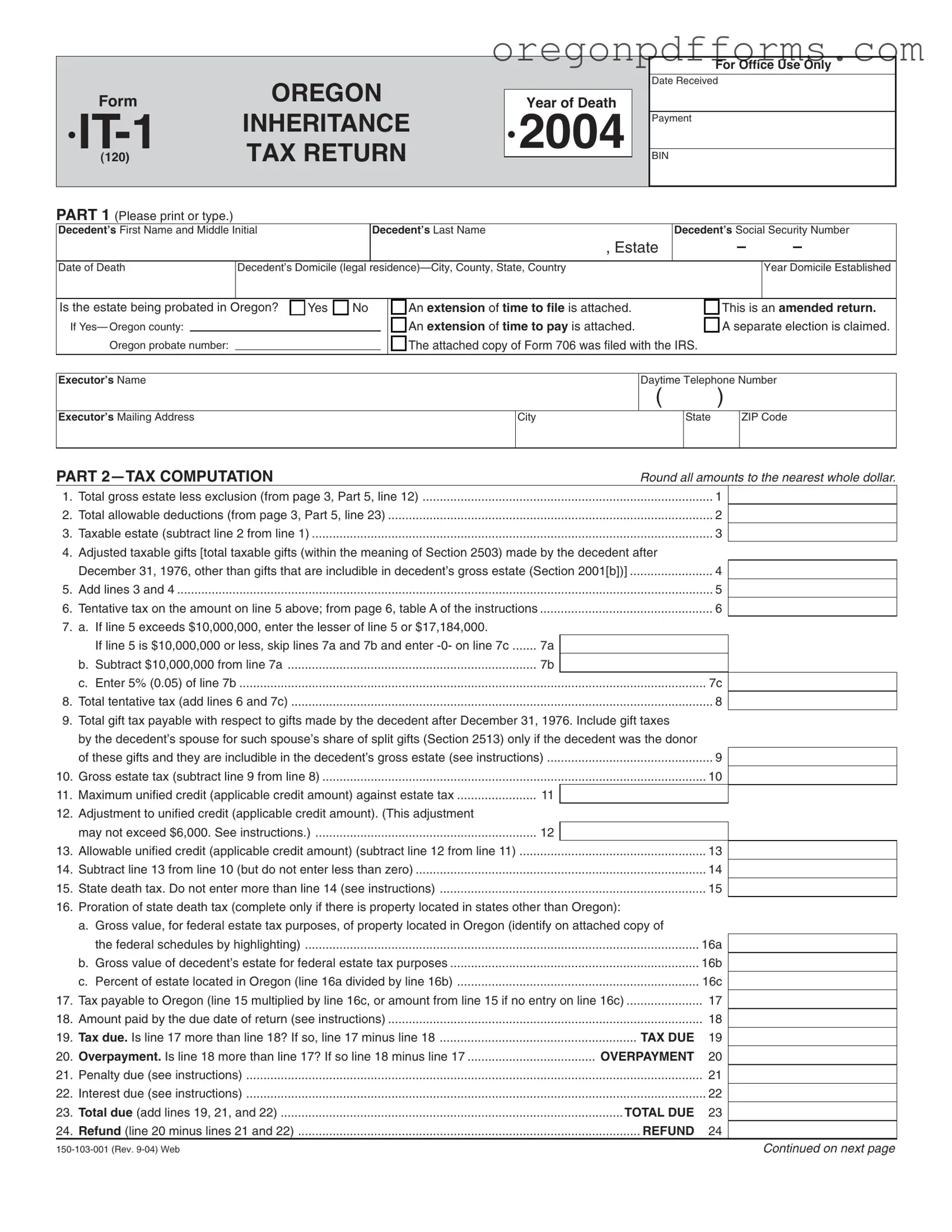

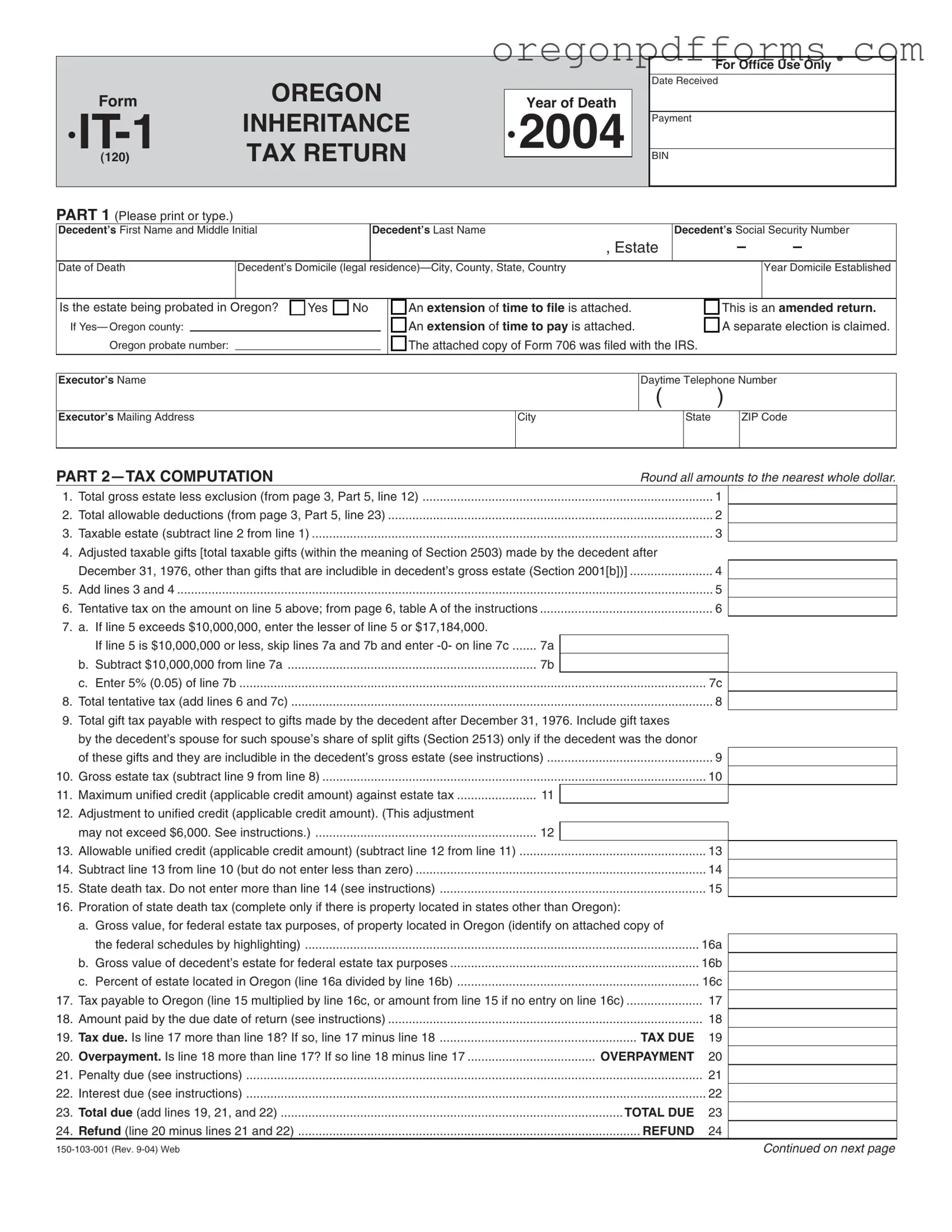

The Oregon IT 1 form is the state’s inheritance tax return. It is used to report the taxable estate of a deceased individual and calculate any taxes owed to the state of Oregon. The form must be completed by the executor or administrator of the estate and submitted to the Oregon Department of Revenue. It includes details about the decedent's estate, deductions, and the calculation of taxes due.

Any executor or administrator of an estate must file the Oregon IT 1 form if the decedent's estate exceeds the exemption threshold set by the state. Generally, estates with a gross value above a certain limit must file this return. It is essential to determine whether the estate is subject to inheritance tax, as this affects the filing requirement.

To complete the IT 1 form, the following information is typically required:

-

Decedent's full name and Social Security number.

-

Date of death and the decedent's legal residence.

-

Details about the gross estate, including assets and liabilities.

-

Any allowable deductions, such as funeral expenses or debts.

-

Information about the executor, including contact details.

Additionally, supporting documents, such as the death certificate and copies of federal estate tax returns, may need to be attached.

The inheritance tax is calculated based on the taxable estate, which is determined by subtracting allowable deductions from the total gross estate. The form includes specific lines to report these amounts, and the tax rate is applied to the taxable estate. The instructions provided with the form detail how to use the tax tables to find the tentative tax amount, which is then adjusted based on any applicable credits.

The IT 1 form is generally due nine months after the date of death of the decedent. If additional time is needed, the executor may file for an extension. However, it is important to remember that an extension for filing does not extend the time to pay any taxes owed. Therefore, any tax due should be paid by the original deadline to avoid penalties and interest.

Yes, the IT 1 form can be amended if errors are discovered after submission. The executor must indicate that the return is an amended return and provide the corrected information. It is crucial to file the amended return as soon as possible to ensure compliance and avoid potential penalties.

If the IT 1 form is not filed when required, the estate may face penalties, including interest on unpaid taxes. Additionally, the estate could be subject to legal action by the state to collect any taxes owed. Executors have a fiduciary duty to ensure that all necessary filings are completed accurately and on time to protect the interests of the beneficiaries and comply with state law.