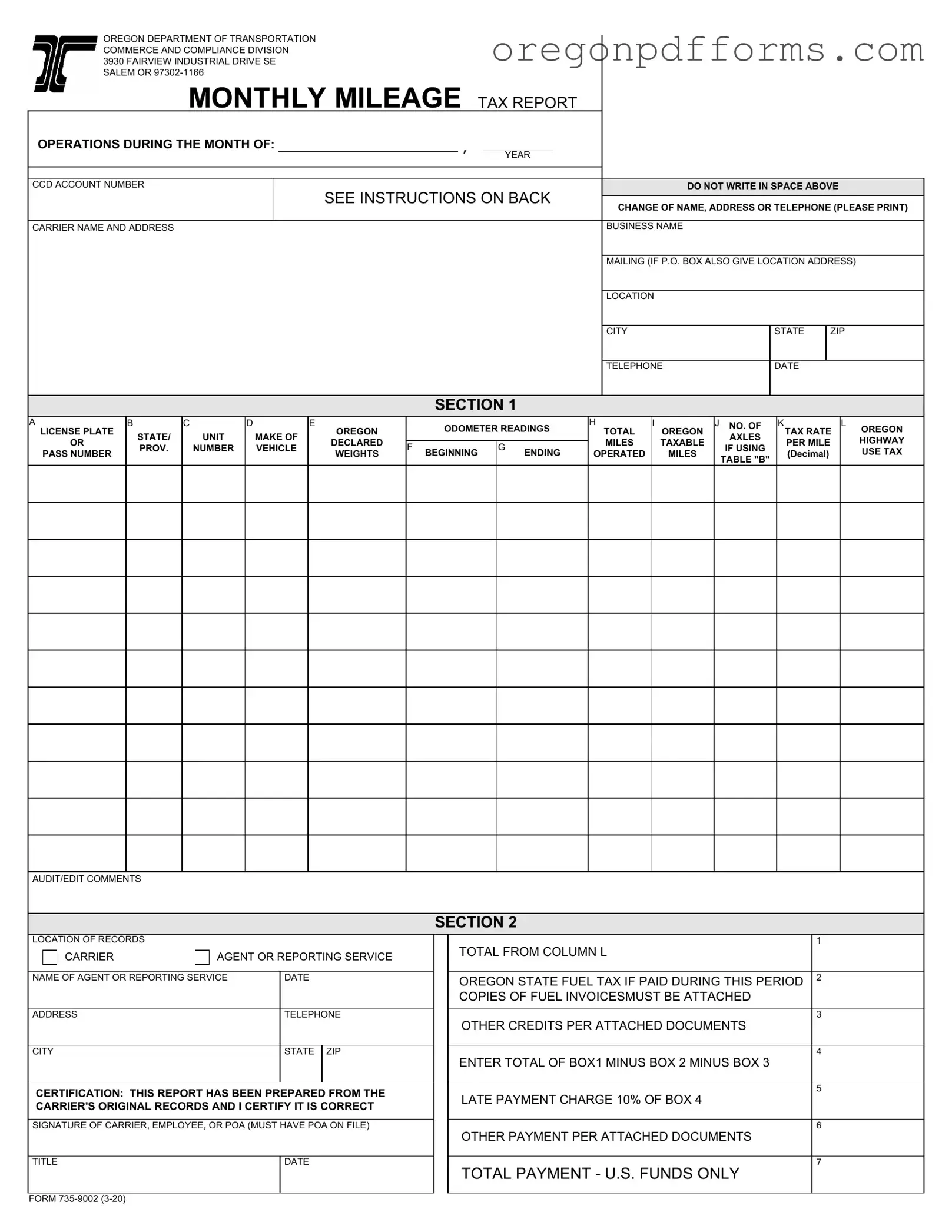

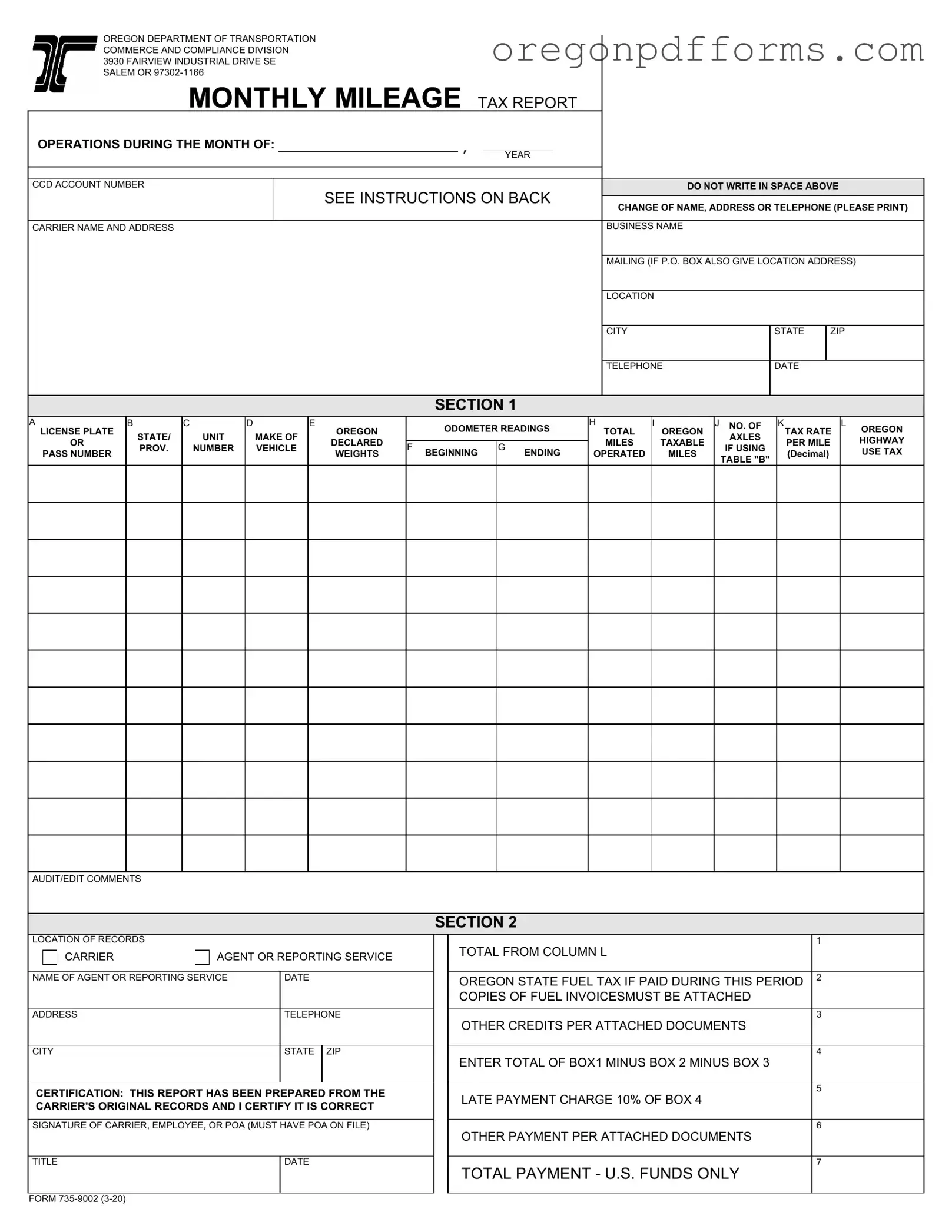

Free Oregon Monthly Mileage Tax Form

The Oregon Monthly Mileage Tax form is a crucial document used by commercial vehicle operators to report mileage and calculate taxes owed for the use of Oregon's public roads. This form ensures compliance with state regulations while facilitating the maintenance and improvement of the highway system. Understanding its requirements is essential for both accurate reporting and the avoidance of penalties.

Open My Oregon Monthly Mileage Tax

Free Oregon Monthly Mileage Tax Form

Open My Oregon Monthly Mileage Tax

Open My Oregon Monthly Mileage Tax

or

Get PDF

A few steps left to finish this form

Complete Oregon Monthly Mileage Tax online with easy edits and saving.