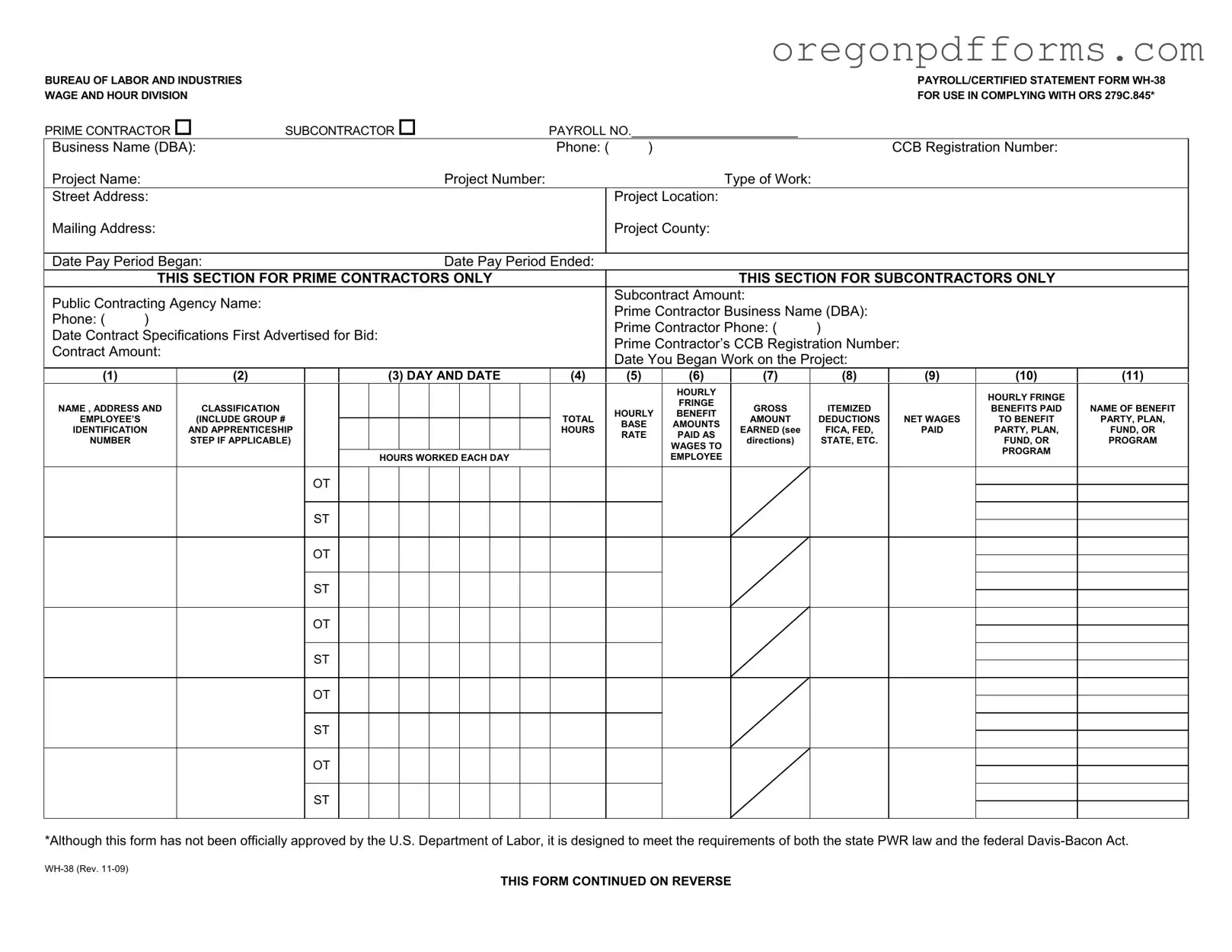

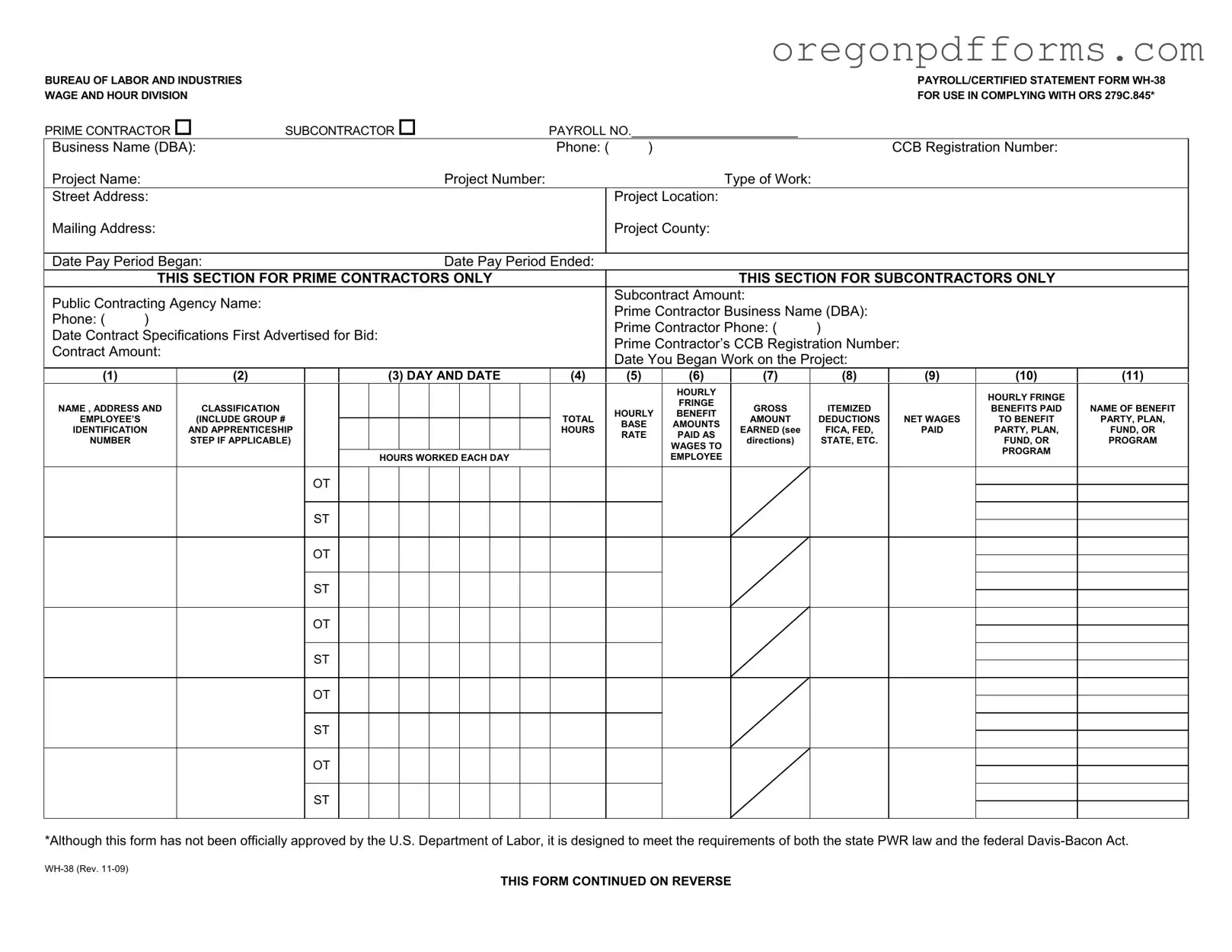

Free Oregon Payroll Wh 38 Form

The Oregon Payroll WH-38 form serves as a crucial document for prime contractors and subcontractors to report payroll information in compliance with state labor laws. This form ensures that all workers on public projects receive fair wages and benefits as mandated by Oregon law and the federal Davis-Bacon Act. Proper completion and submission of the WH-38 help maintain transparency and accountability in public contracting.

Open My Oregon Payroll Wh 38

Free Oregon Payroll Wh 38 Form

Open My Oregon Payroll Wh 38

Open My Oregon Payroll Wh 38

or

Get PDF

A few steps left to finish this form

Complete Oregon Payroll Wh 38 online with easy edits and saving.