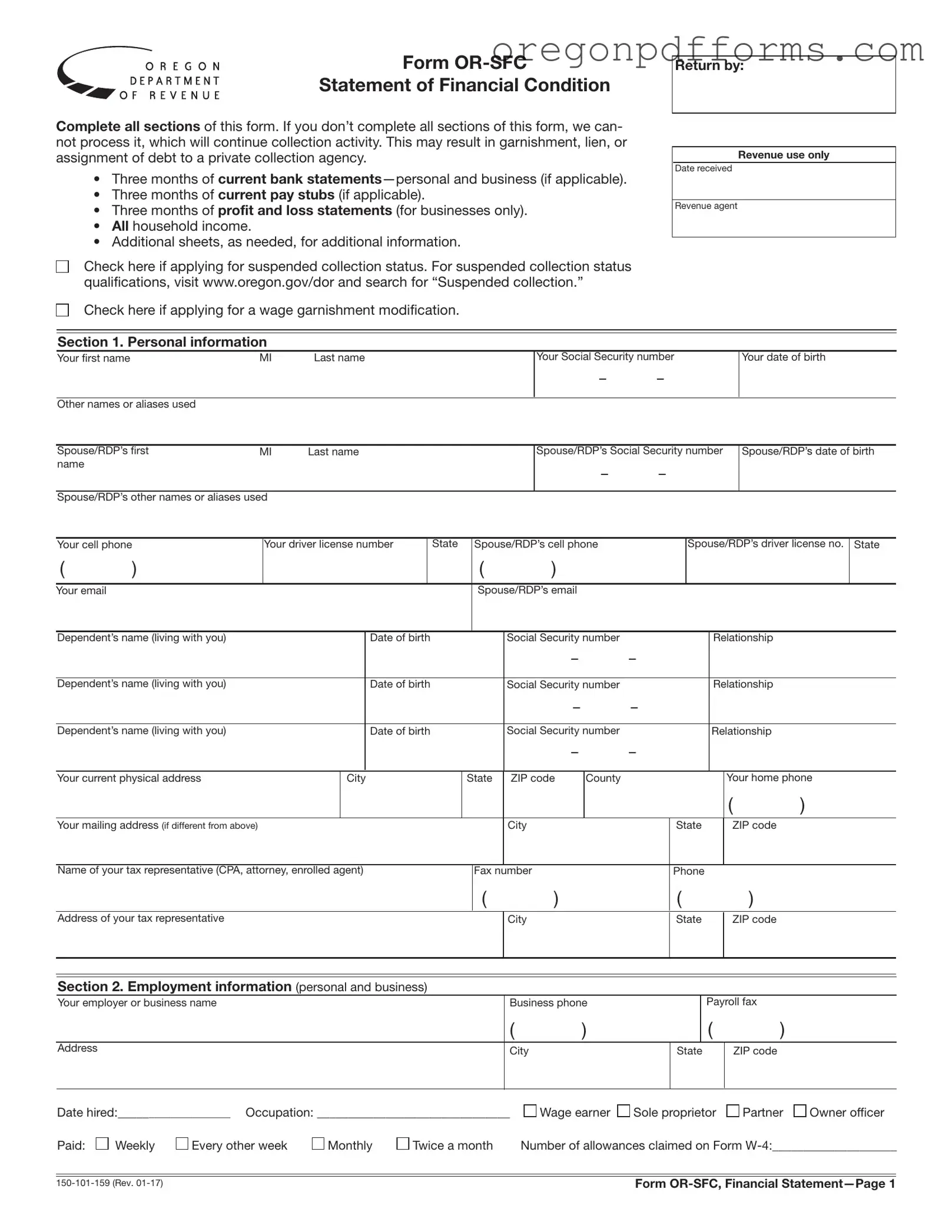

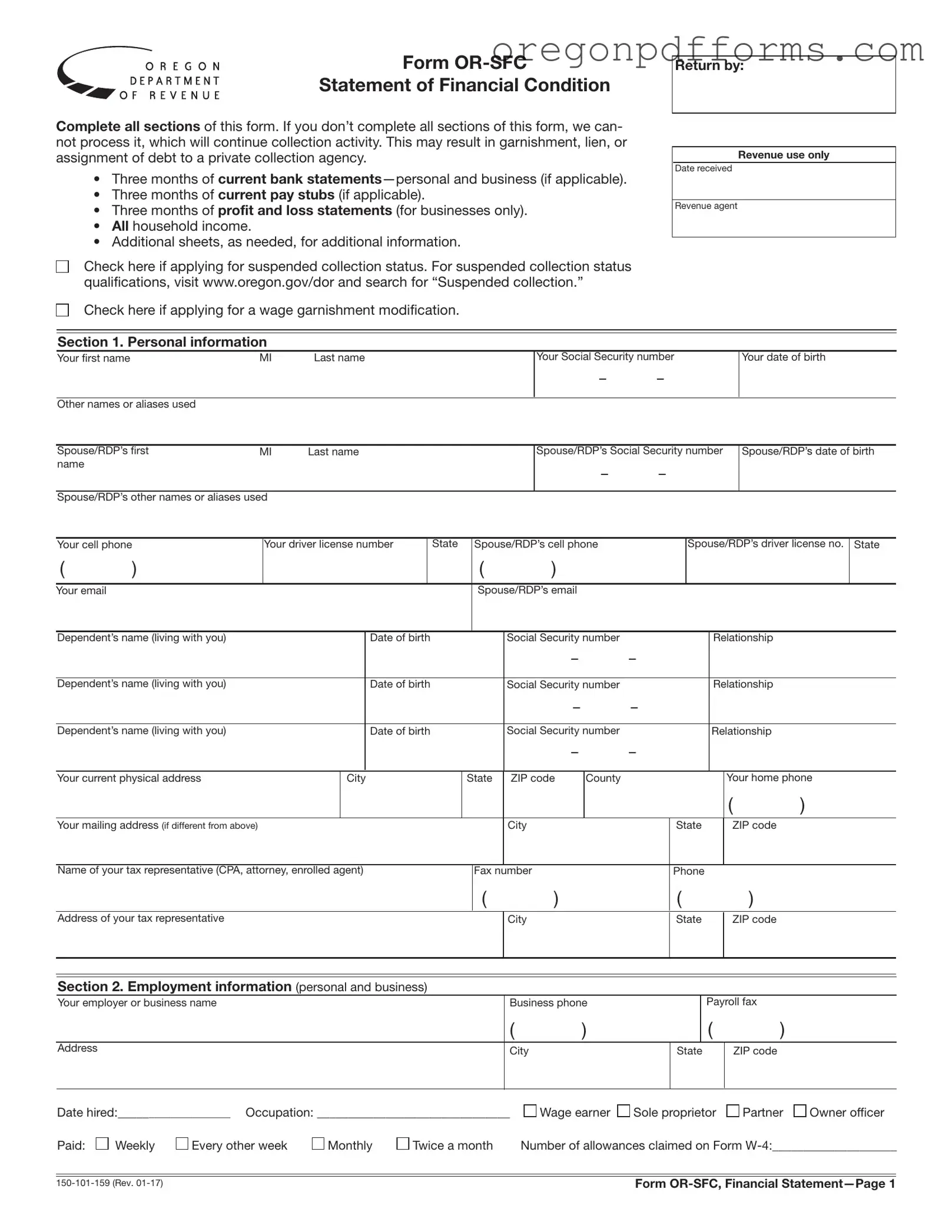

The Oregon Statement Form, also known as Form OR-SFC, is a financial document required by the state of Oregon. It helps the Department of Revenue assess an individual's or business's financial condition. Completing this form is crucial for managing tax obligations and can influence collection activities.

Individuals and businesses facing tax liabilities or collection activities should complete this form. If you have received notices regarding unpaid taxes or are seeking a suspended collection status or a wage garnishment modification, filling out this form is essential.

The form requires detailed personal and financial information, including:

-

Personal details (name, Social Security number, date of birth)

-

Employment information (employer name, occupation, income)

-

Bank account details (balances, types of accounts)

-

Asset information (vehicles, real estate, personal property)

-

Liabilities (credit card debt, loans, other financial obligations)

Make sure to provide accurate and complete information to avoid delays in processing.

If any sections of the form are left incomplete, the Department of Revenue cannot process it. This may lead to continued collection activities, including potential garnishments, liens, or assignment of your debt to a private collection agency. Therefore, it is crucial to fill out every section thoroughly.

Along with the completed form, you will need to provide several supporting documents:

-

Three months of current bank statements (both personal and business, if applicable).

-

Three months of current pay stubs (if applicable).

-

Three months of profit and loss statements (for businesses only).

-

Additional sheets for any extra information you may need to include.

These documents help verify the information you provide in the form.

How do I apply for suspended collection status?

If you wish to apply for suspended collection status, you can check the appropriate box on the form. For more information on the qualifications and process, visit the Oregon Department of Revenue's website and search for "Suspended collection." This status can provide temporary relief from collection activities while your financial situation is assessed.

Yes, if you are seeking to modify an existing wage garnishment, you can indicate this on the form by checking the appropriate box. This request will be reviewed, and you may need to provide additional documentation to support your case.

The information you provide on the Oregon Statement Form is used by the Department of Revenue to evaluate your financial condition. It helps determine your ability to pay taxes and assess your eligibility for payment plans or other relief options. Your data is handled confidentially, adhering to privacy regulations.

For more details about the Oregon Statement Form, including instructions and resources, you can visit the Oregon Department of Revenue's official website. Here, you can find additional guidance on completing the form and understanding your rights and responsibilities related to tax obligations.