What is a Promissory Note in Oregon?

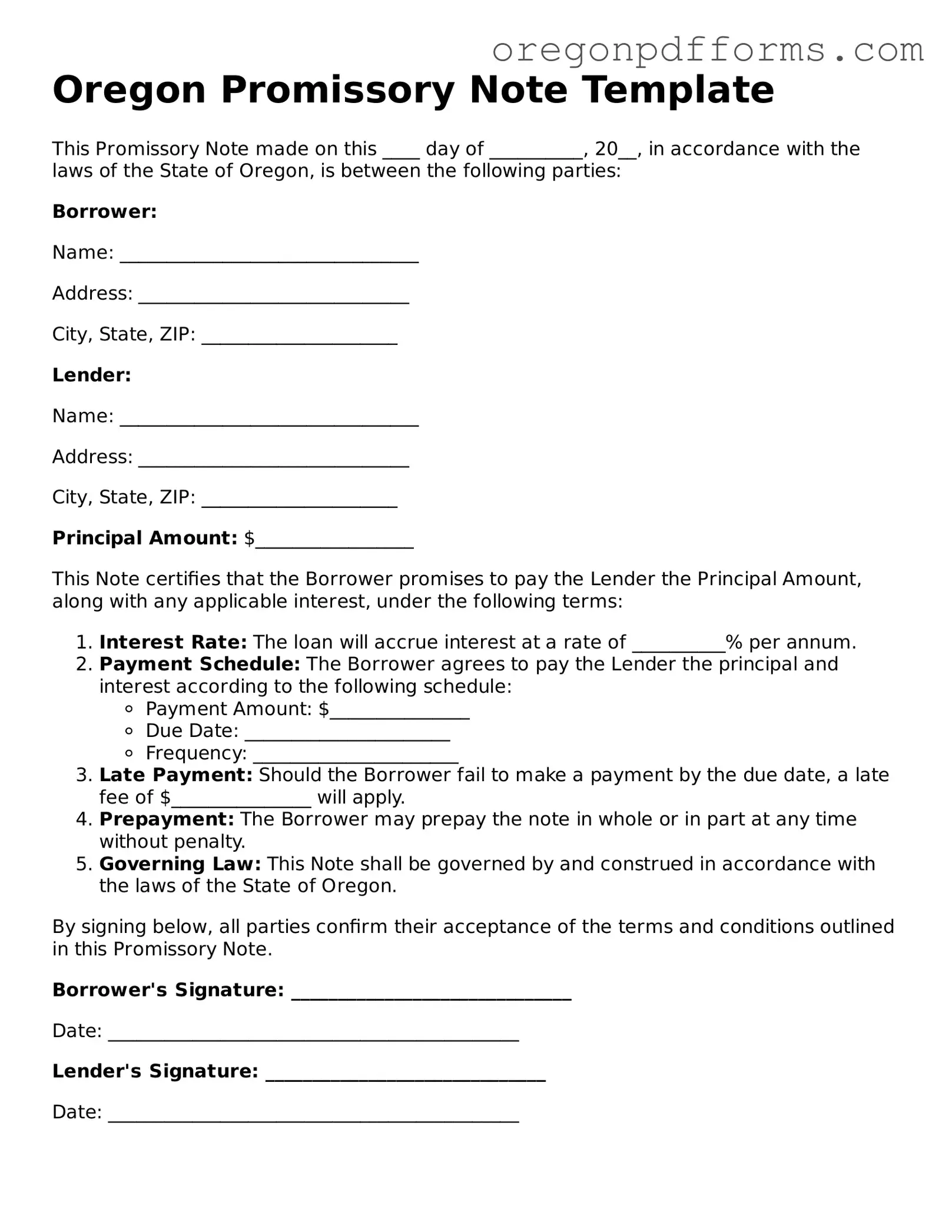

A Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a defined time or on demand. In Oregon, this document serves as a legal instrument that outlines the terms of a loan, including the principal amount, interest rate, payment schedule, and any penalties for late payments. It is important for both the lender and borrower to understand their rights and obligations under the note.

What are the essential elements of an Oregon Promissory Note?

An Oregon Promissory Note should include the following key elements:

-

Parties Involved:

Clearly identify the lender and borrower.

-

Principal Amount:

Specify the amount being borrowed.

-

Interest Rate:

State the interest rate, if applicable, and whether it is fixed or variable.

-

Payment Terms:

Outline the payment schedule, including due dates and the number of payments.

-

Maturity Date:

Indicate when the loan must be fully repaid.

-

Signatures:

Both parties must sign the note to make it legally binding.

Do I need to have the Promissory Note notarized?

While notarization is not a strict requirement for a Promissory Note in Oregon, it is highly recommended. Having the document notarized can provide an extra layer of protection for both parties. It helps verify the identities of the signers and confirms that they signed the document voluntarily. This can be particularly useful if disputes arise in the future.

What happens if the borrower defaults on the Promissory Note?

If the borrower fails to make payments as agreed, they are considered to be in default. The lender has several options to address this situation:

-

Contact the borrower to discuss the missed payments and seek a resolution.

-

Charge late fees as outlined in the note.

-

Initiate legal proceedings to recover the owed amount, which may include filing a lawsuit.

-

Consider negotiating a payment plan or settlement.

It is advisable for lenders to document all communications and actions taken in case legal action becomes necessary.

Can I modify the terms of a Promissory Note after it has been signed?

Yes, the terms of a Promissory Note can be modified after it has been signed, but both parties must agree to the changes. This agreement should be documented in writing and signed by both the lender and borrower. It is crucial to ensure that any modifications do not violate state laws or the original terms of the note.

Is there a statute of limitations for enforcing a Promissory Note in Oregon?

Yes, Oregon has a statute of limitations that applies to Promissory Notes. Generally, the time limit for enforcing a written contract, including a Promissory Note, is six years from the date of default. After this period, the lender may lose the right to take legal action to collect the debt. It is important to keep track of payment schedules and any defaults to ensure that rights are protected within this timeframe.