Valid Small Estate Affidavit Document for Oregon

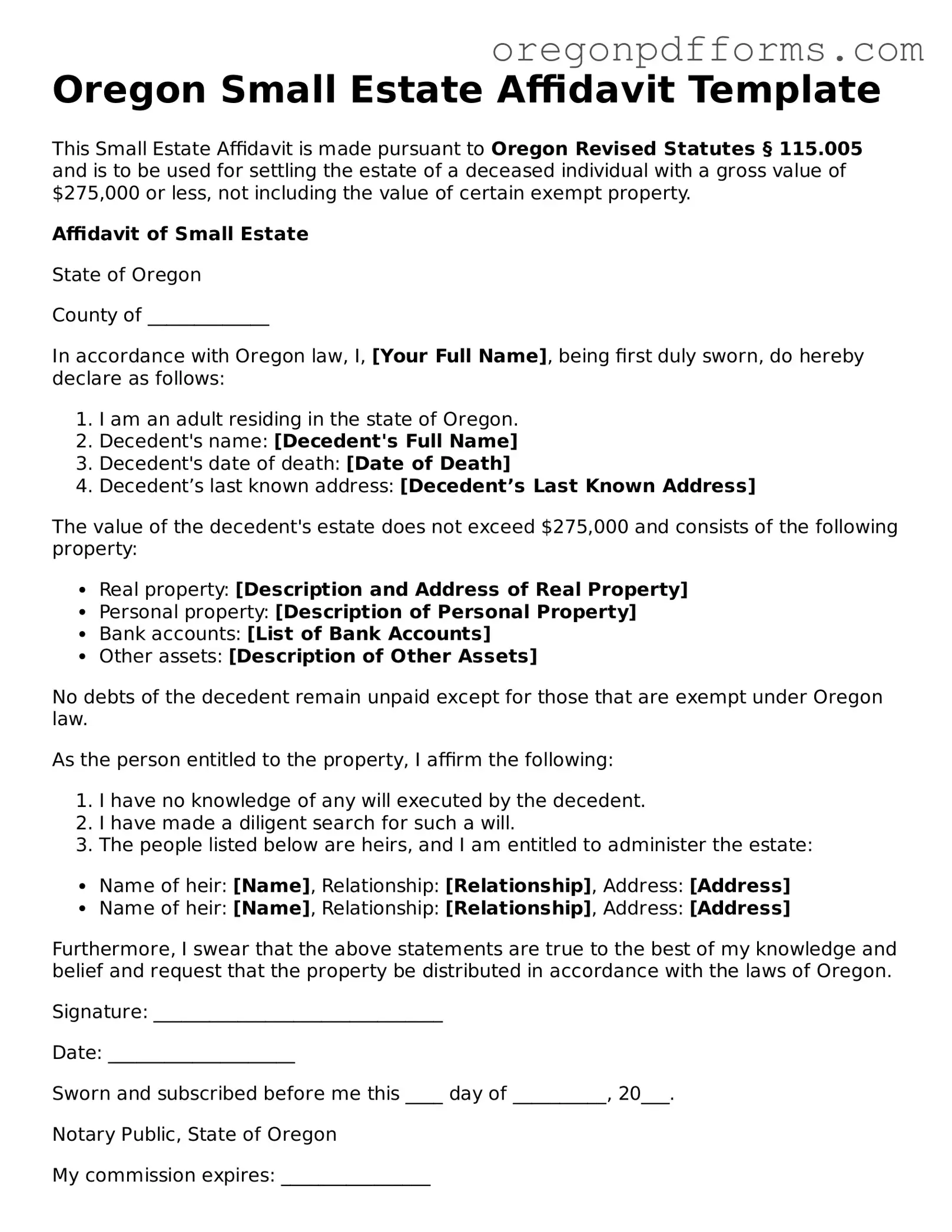

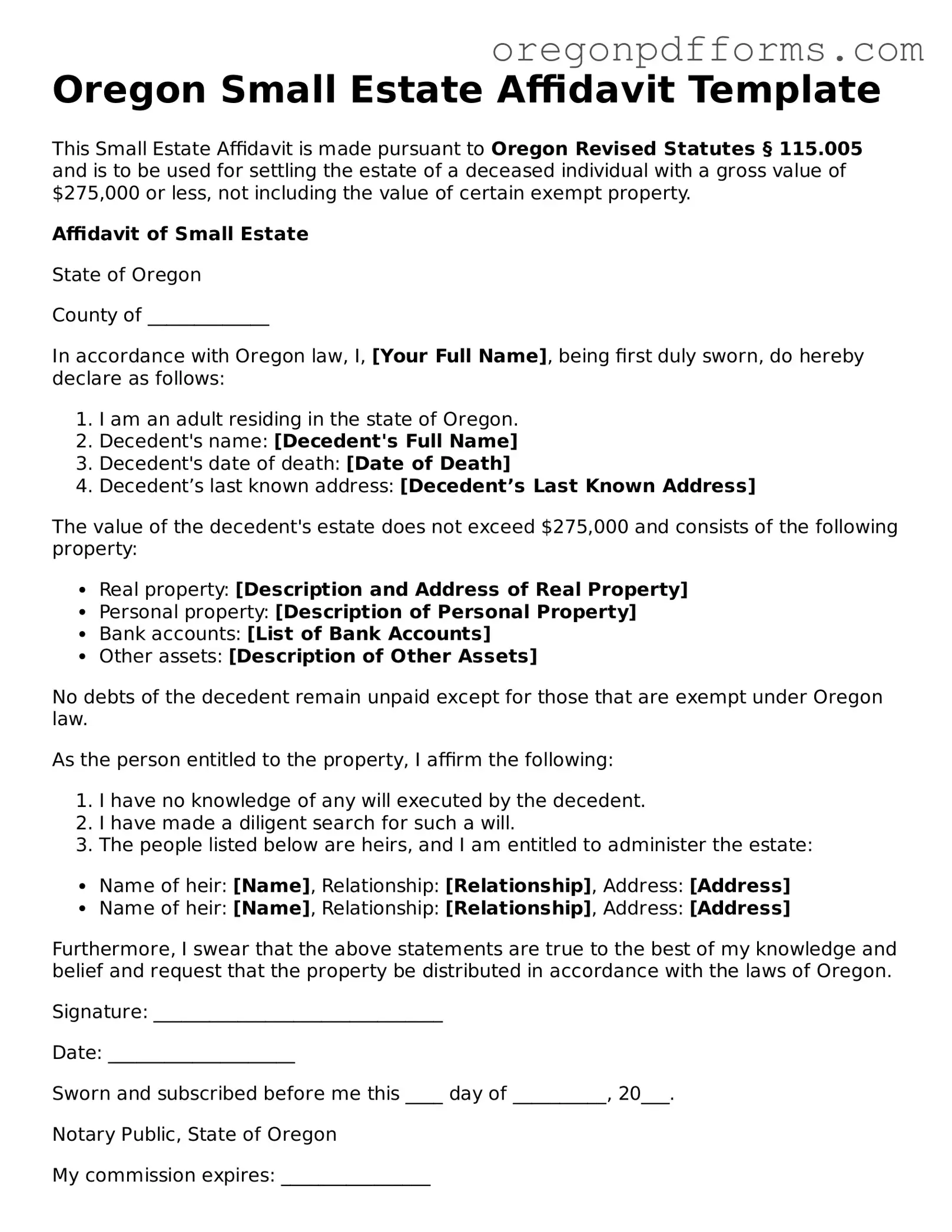

The Oregon Small Estate Affidavit is a legal document that allows individuals to claim assets from a deceased person's estate without going through the lengthy probate process. This form simplifies the transfer of property when the estate's total value is below a certain threshold. Understanding how to use this affidavit can help heirs and beneficiaries access their inheritance more efficiently.

Open My Small Estate Affidavit

Valid Small Estate Affidavit Document for Oregon

Open My Small Estate Affidavit

Open My Small Estate Affidavit

or

Get PDF

A few steps left to finish this form

Complete Small Estate Affidavit online with easy edits and saving.