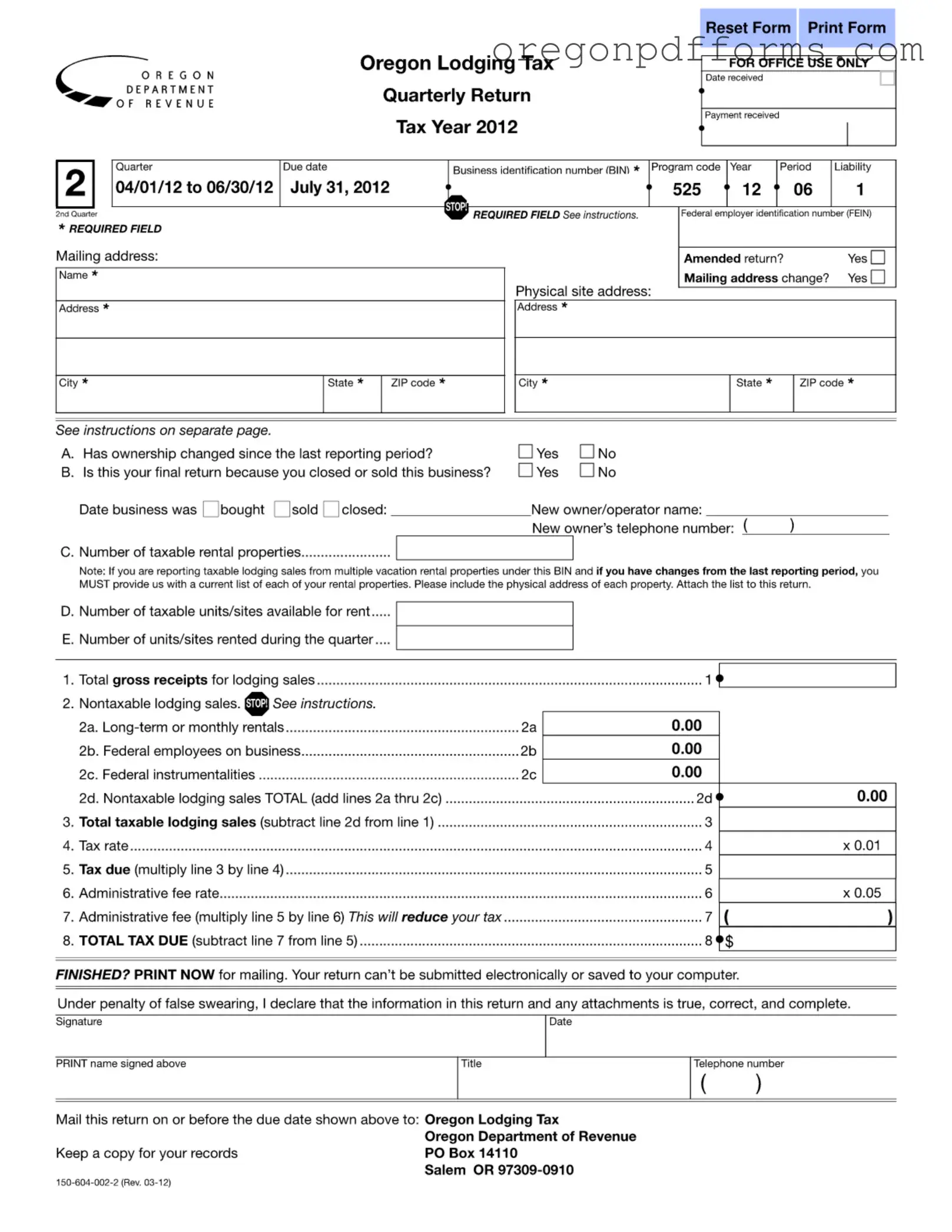

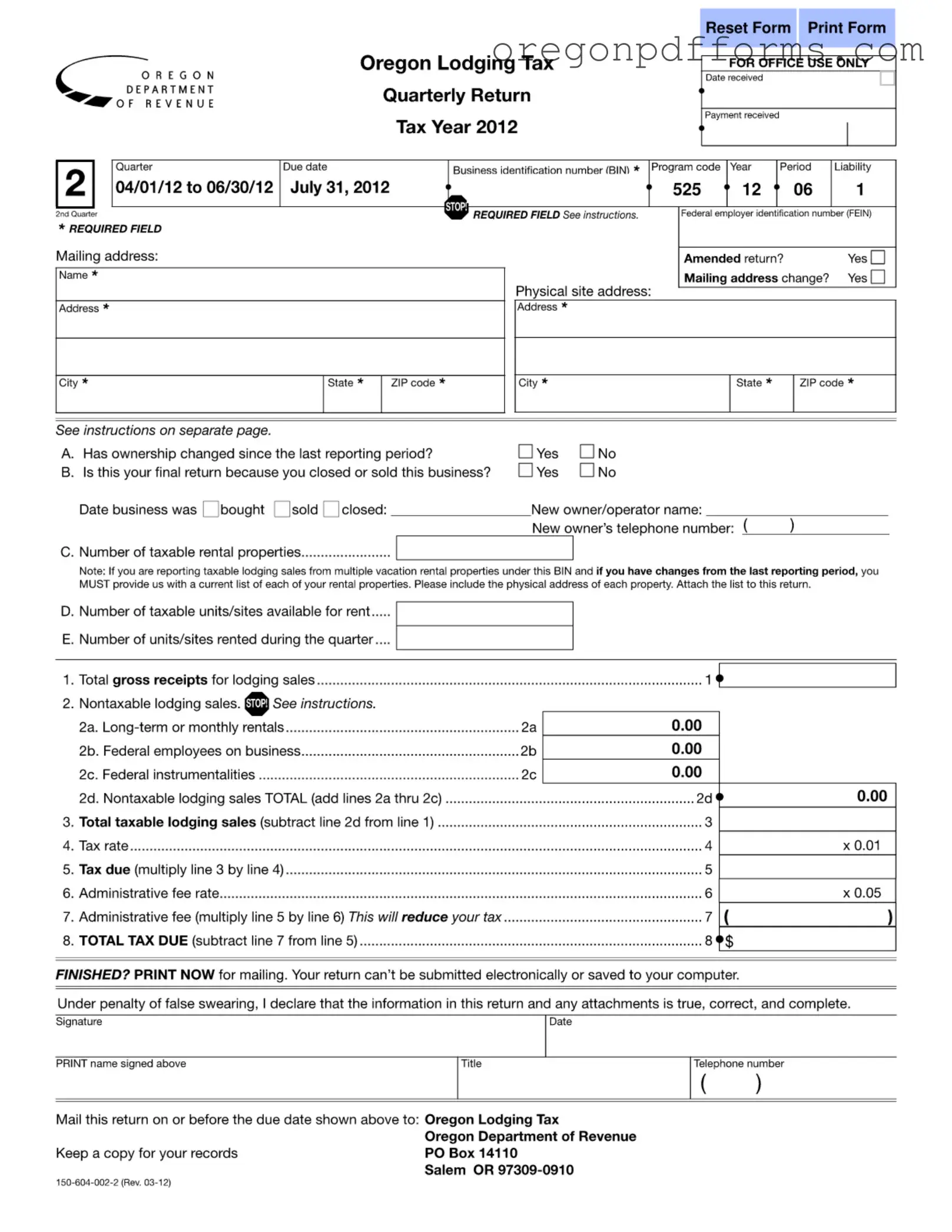

Free State Of Oregon Lodging Tax Form

The State of Oregon Lodging Tax form is a document that lodging providers must complete to report their taxable lodging sales and pay the associated tax. This form is essential for ensuring compliance with state tax regulations and is due quarterly. Understanding how to accurately fill out this form can help avoid penalties and ensure that all necessary information is reported correctly.

Open My State Of Oregon Lodging Tax

Free State Of Oregon Lodging Tax Form

Open My State Of Oregon Lodging Tax

Open My State Of Oregon Lodging Tax

or

Get PDF

A few steps left to finish this form

Complete State Of Oregon Lodging Tax online with easy edits and saving.