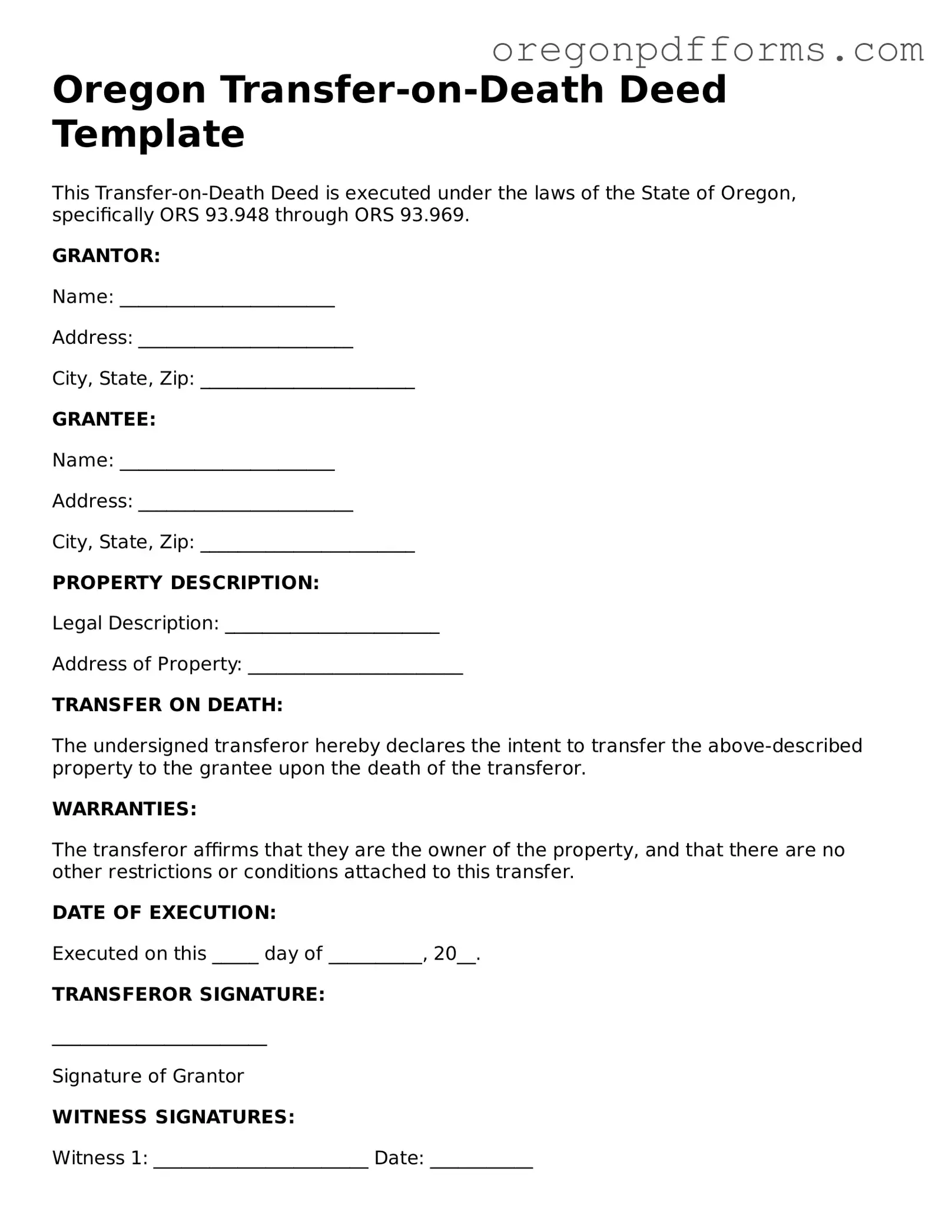

What is a Transfer-on-Death Deed in Oregon?

A Transfer-on-Death Deed (TODD) allows property owners in Oregon to transfer their real estate to a designated beneficiary upon their death, without the need for probate. This means that the property can pass directly to the beneficiary, simplifying the process and potentially saving time and costs associated with estate administration.

Who can create a Transfer-on-Death Deed?

Any individual who owns real property in Oregon can create a Transfer-on-Death Deed. This includes homeowners and property investors. However, it is essential that the property owner is of sound mind and legally capable of making such decisions at the time of creating the deed.

How do I designate a beneficiary in a Transfer-on-Death Deed?

When filling out the Transfer-on-Death Deed form, you will need to clearly specify the name of the beneficiary. It’s important to provide accurate details, such as the beneficiary’s full name and address. You can designate one or more beneficiaries, and you may also include alternative beneficiaries in case the primary beneficiary predeceases you.

Do I need to file the Transfer-on-Death Deed with the county?

Yes, the Transfer-on-Death Deed must be recorded with the county clerk's office where the property is located. This recording makes the deed a matter of public record and ensures that the beneficiary's rights are recognized upon your death. It’s advisable to file the deed as soon as it is completed and signed.

Can I change or revoke a Transfer-on-Death Deed?

Yes, you can change or revoke a Transfer-on-Death Deed at any time while you are alive. To do this, you will need to create a new deed or a revocation form and file it with the county clerk. Keep in mind that the new deed must be properly executed and recorded to be valid.

What happens if I do not have a Transfer-on-Death Deed?

If you do not have a Transfer-on-Death Deed, your property will typically go through probate upon your death. This legal process can be time-consuming and may involve court fees, attorney costs, and other expenses. Additionally, the distribution of your property may be subject to state laws regarding intestacy if you do not have a will.

Are there any limitations on what property can be transferred using a Transfer-on-Death Deed?

Yes, not all types of property can be transferred using a Transfer-on-Death Deed. Generally, only real estate, such as land and buildings, qualifies. Personal property, bank accounts, and other assets typically cannot be transferred using this deed. It’s important to consult with a professional if you have questions about specific types of property.

Is there a fee associated with recording a Transfer-on-Death Deed?

Yes, there is usually a fee for recording a Transfer-on-Death Deed with the county clerk’s office. The fee can vary by county, so it’s a good idea to check with your local office for the exact amount. Additionally, there may be costs associated with preparing the deed, especially if you seek assistance from a legal professional.