Free Wr Oregon Form

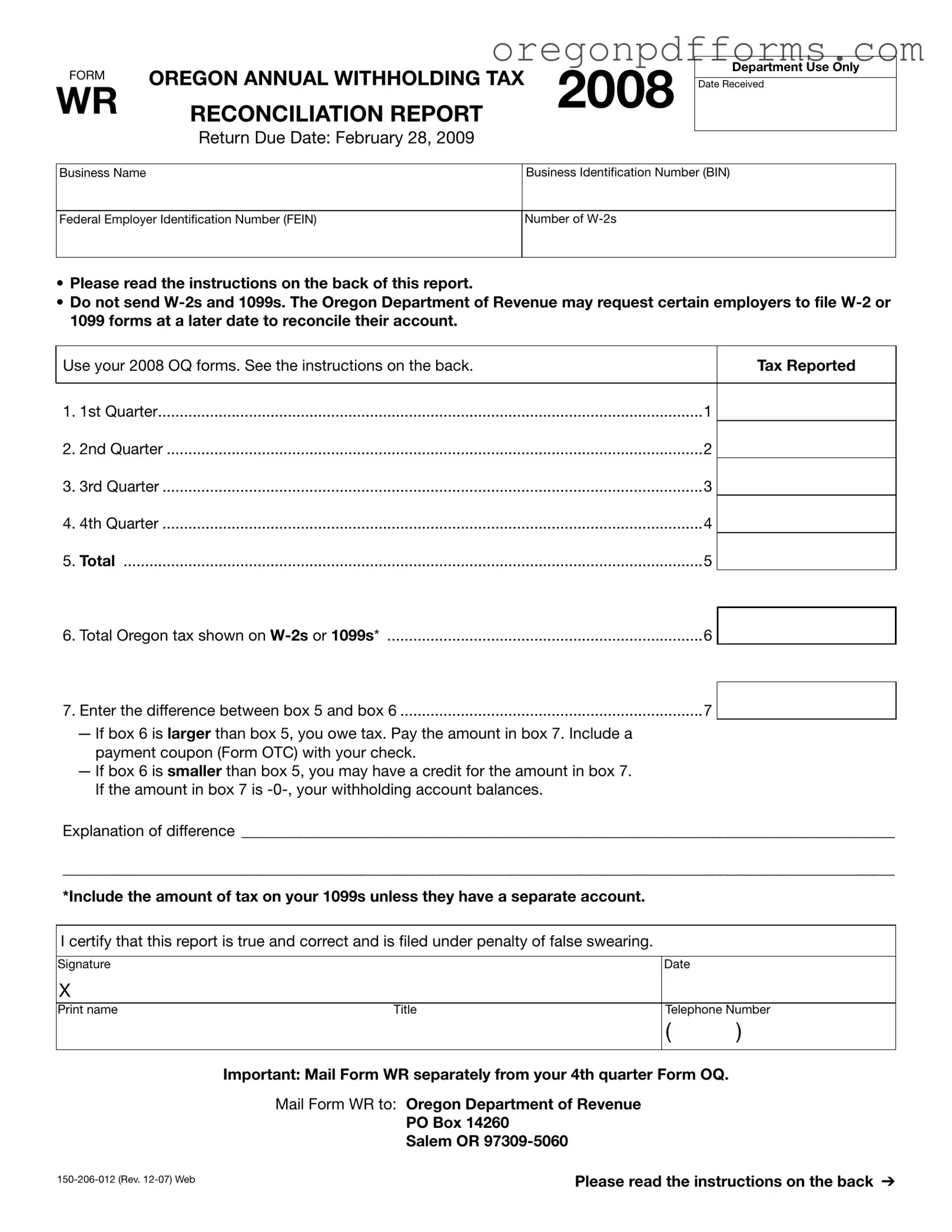

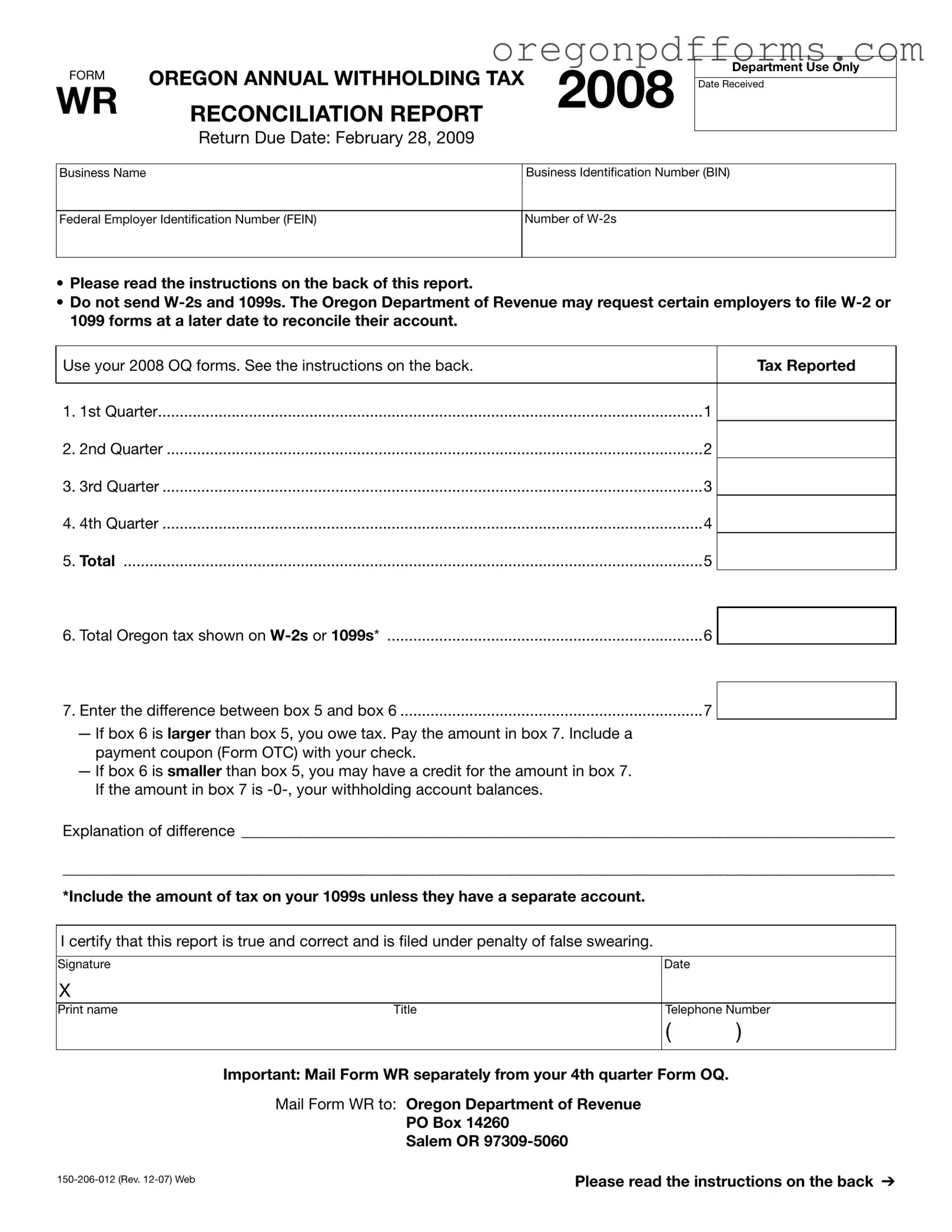

The WR Oregon form is the Oregon Annual Withholding Tax Reconciliation Report that employers must submit to the Oregon Department of Revenue. This form is essential for reporting the total state withholding tax for the year and reconciling any discrepancies between the amounts withheld and reported on employee W-2s or 1099s. Timely and accurate completion of this form ensures compliance and helps avoid potential penalties.

Open My Wr Oregon

Free Wr Oregon Form

Open My Wr Oregon

Open My Wr Oregon

or

Get PDF

A few steps left to finish this form

Complete Wr Oregon online with easy edits and saving.